Featured

H And R Block Amend Taxes

If HR Block doesnt find anything the taxpayer doesnt need to amend. Basic Best for simple tax situations 1947.

Irs Notice Cp22a Changes To Your Form 1040 H R Block

Irs Notice Cp22a Changes To Your Form 1040 H R Block

Like most companies HR Block allows you to pay for tax prep and other related fees right from your federal or state refund payment but youll be charged a 39 Refund Transfer fee.

H and r block amend taxes. If youre using tax preparation software like TurboTax or HR Block youll be. For example HR Block allows its clients to complete their own taxes online and offers a 35 discount for doing so. I read that Hr block modified the program to allow form 1040x to send to IRS electronically Im in Oceanside NY buying your program every year for the last 10-15 or.

And with approximately 10000 tax offices in all 50 states as well as US. Pretty simple right. Check the Form 1040X Instructions to find your states IRS Service Center address.

Please note that the instructions assume that you prepared your return using TurboTax. Yes you may use TurboTax to amend your income tax returns even if you prepared them with another tax preparer. If there is a mistake or overlooked tax benefit the HR Block tax professional can prepare a tax amendment 1040X.

You can access the Form 1040X on the IRS website. To keep it short and sufficient I filed my taxes with HR Block free edition online on their website. An HR Block tax professional will determine if there are any mistakes or if they were eligible for credits that could have increased their refund.

TurboTax and HR Block updated their online software to account for a new tax break on unemployment benefits received in 2020. Today I found out I might have to amend my taxes. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due.

Since you did not you will have to enter the information from your return as originally filed. WASHINGTON NEXSTAR The American Rescue Plan Act of 2021 includes guidance on how tax filers c an waive federal tax liability on up to 10200 of unemployment compensation in 2020. HR Block is a global leader in tax preparation services - preparing one in every seven US.

HR Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an. CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Unfortunately you cant e-file Form 1040-X.

If you discover an HR Block error on your return that entitles you to a larger refund or smaller tax liability well refund the tax prep fee for that return and file an amended return at no additional charge. Youll have to print and mail it. If you find an error in the HR Block online tax program that entitles you to a larger refund or smaller liability we will refund the fees you paid us to use our program to prepare that return and you may use our program to amend your return at no additional charge.

Youll need to send an amended return by mail. Arizona and Vermont for example are allowing residents to claim the tax break on state tax forms but havent yet officially adopted the federal rule according to HR Block. The American Rescue Plan a.

The address you send your amended tax return to will depend on the particulars of your filing situation. Expires January 31 2021. So I went online on HR Blocks website my account and clicked Amend my tax return put in the experimental amount a few times just to see what my new total amended would be then left.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer. Or of course HR Block tax professionals can help you file an amended. There are 4 online versions to choose from.

With HR Block online software youre going to be able to claim every credit and deduction available to you. Tax returns through retail locations and at-home digital solutions since 1955. Territories military bases and abroad were always available to help you file your taxes.

1040x Amended Tax Return H R Block

1040x Amended Tax Return H R Block

Correcting Mistakes After You File Amended Tax Returns

Correcting Mistakes After You File Amended Tax Returns

Tax Help Tips Tools Tax Questions Answered H R Block

Tax Help Tips Tools Tax Questions Answered H R Block

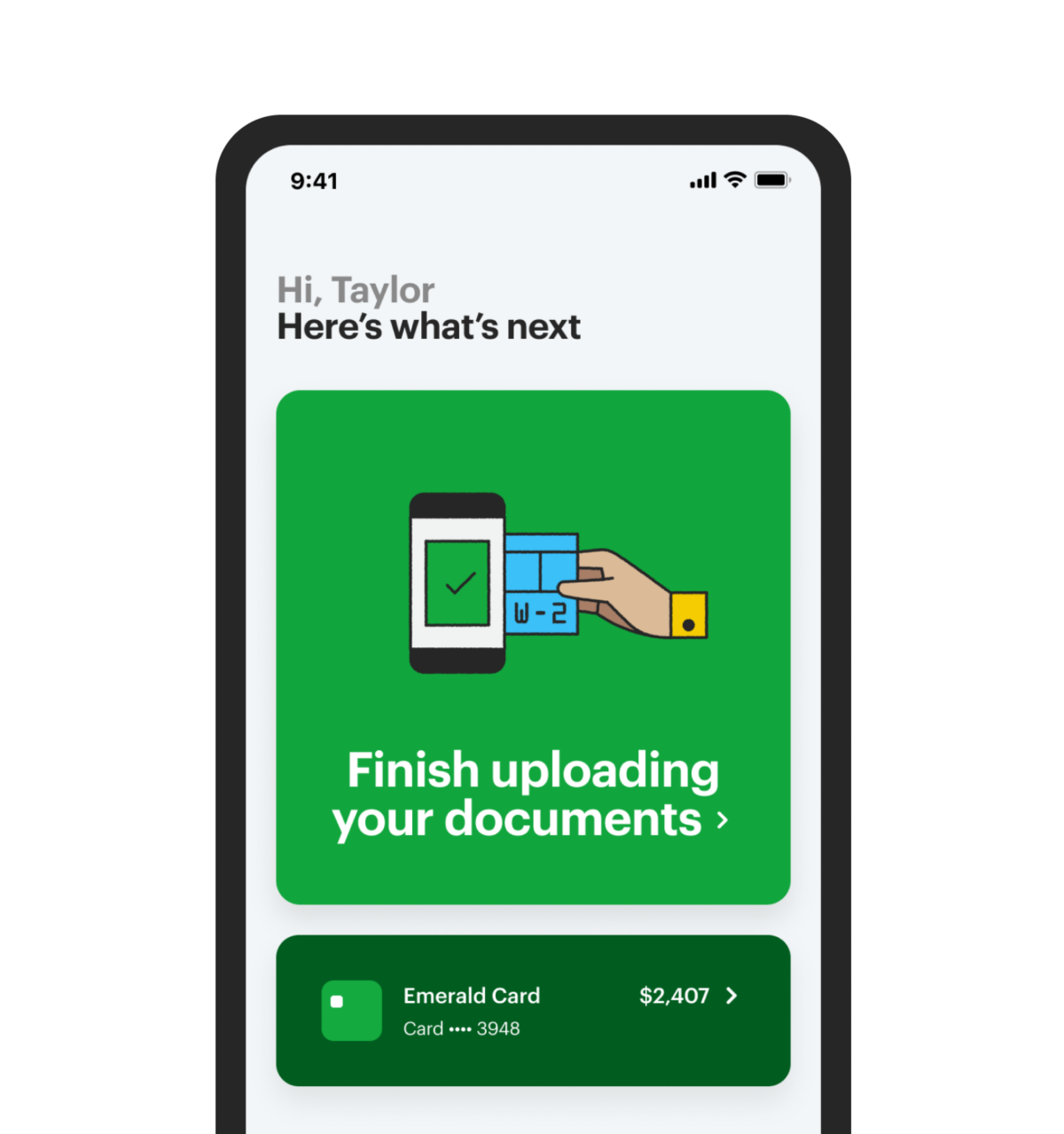

Featured Product H R Block Online Free Edition

Featured Product H R Block Online Free Edition

Will I Get Audited If I File An Amended Return H R Block

Will I Get Audited If I File An Amended Return H R Block

Irs Letter 4364c Amended Return Notification H R Block

Irs Letter 4364c Amended Return Notification H R Block

Irs Letter 89c Amended Return Required To Correct Account H R Block

Irs Letter 89c Amended Return Required To Correct Account H R Block

Guide To Doing Your Own Taxes How You Want H R Block Newsroom

Guide To Doing Your Own Taxes How You Want H R Block Newsroom

Featured Product H R Block Online Free Edition

Featured Product H R Block Online Free Edition

Irs Letter 5599 Advanced Premium Tax Credit Recipients No Form 8962 Filed H R Block

Irs Letter 5599 Advanced Premium Tax Credit Recipients No Form 8962 Filed H R Block

How To Amend A Tax Return H R Block

How To Amend A Tax Return H R Block

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment