Featured

- Get link

- X

- Other Apps

1099 For Babysitting

Her babysitting earnings minus her babysitting expenses might be 400 or more. The lady that I will be babysitting for has told me that I will be receiving a 1099-Form at the end of the year.

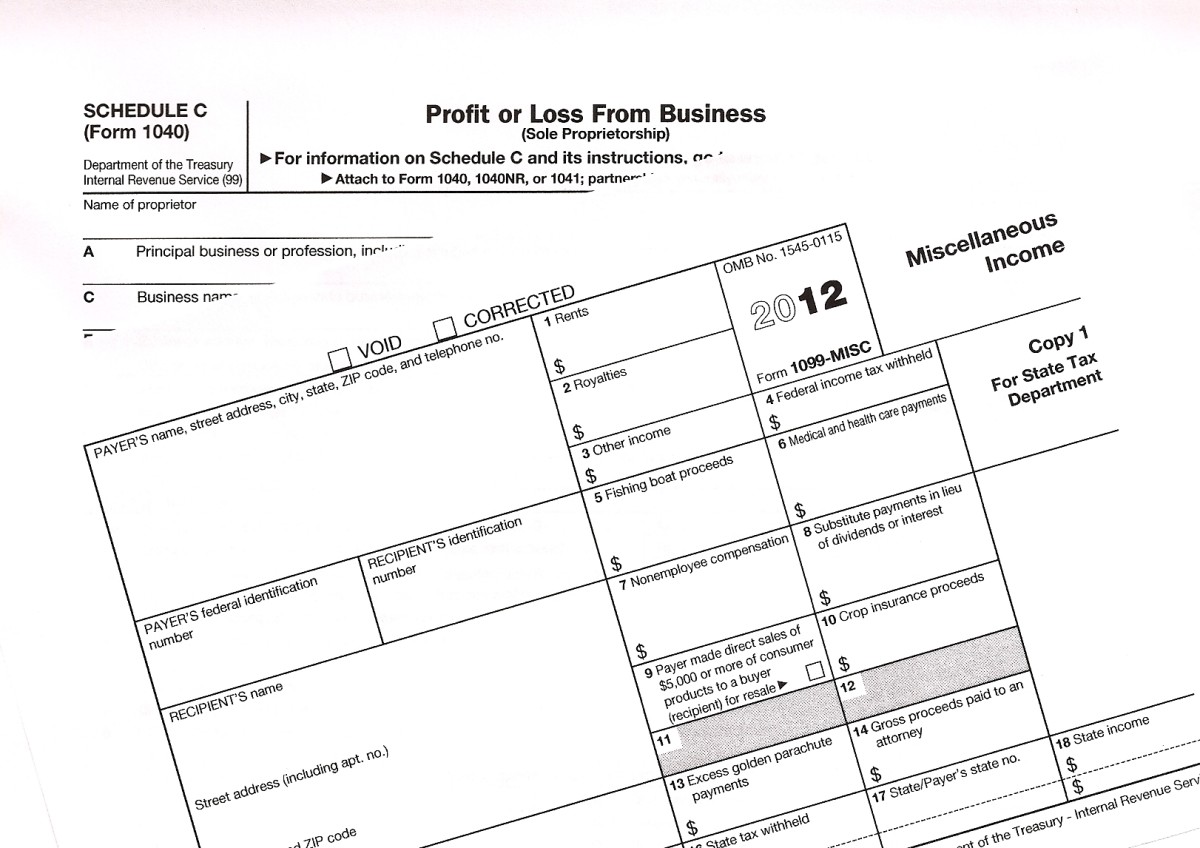

What Is A 1099 Form With Pictures

What Is A 1099 Form With Pictures

If you have a household employee the babysitter worked in your home you may need to withhold and pay social security and Medicare taxes pay federal unemployment tax or both.

1099 for babysitting. Not only do you have to withhold FICA from your nannys paychecks but you are responsible for paying 765 62 for Social Security tax. Then the total paid on all 1099s in box 5. In this case your mother wouldnt be subject to self-employment tax.

If a babysitter or nanny is self-employed you dont have reporting or withholding requirements. This will take you directly to the section where you can enter your 1099-MISC. Businesses send out a 1099-MISC when they pay a non-employee 600 or more over the course of a year.

If they do and you earned more than 600 from any one family during the year they must provide you with a 1099 form that shows how much they paid you. Ask the families for whom you babysit if they are going to claim your services on their taxes as a household deduction. Thats only a requirement for businesses -- when you pay someone.

Self-employed workers usually provide their own tools. You will indicate that you are filing 1099. As a babysitter you might get a form 1099-MISC from the families you babysit for if your pay for the year exceeded 600.

Form 1099 for Nannies Who Are Self-Employed. Collect 1099 forms from every family from whom you earned more than 600. Youll also be able to enter any cash personal checks or.

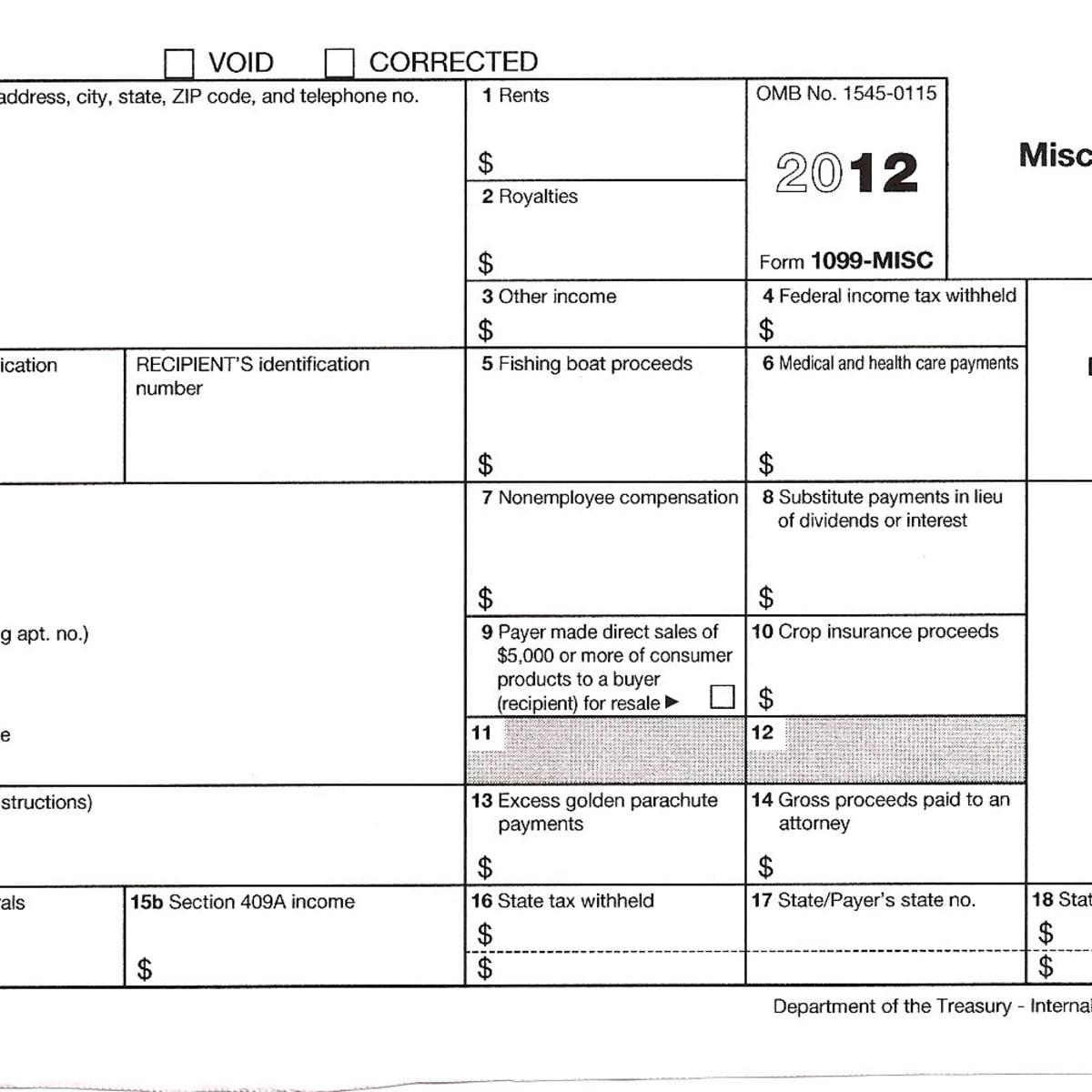

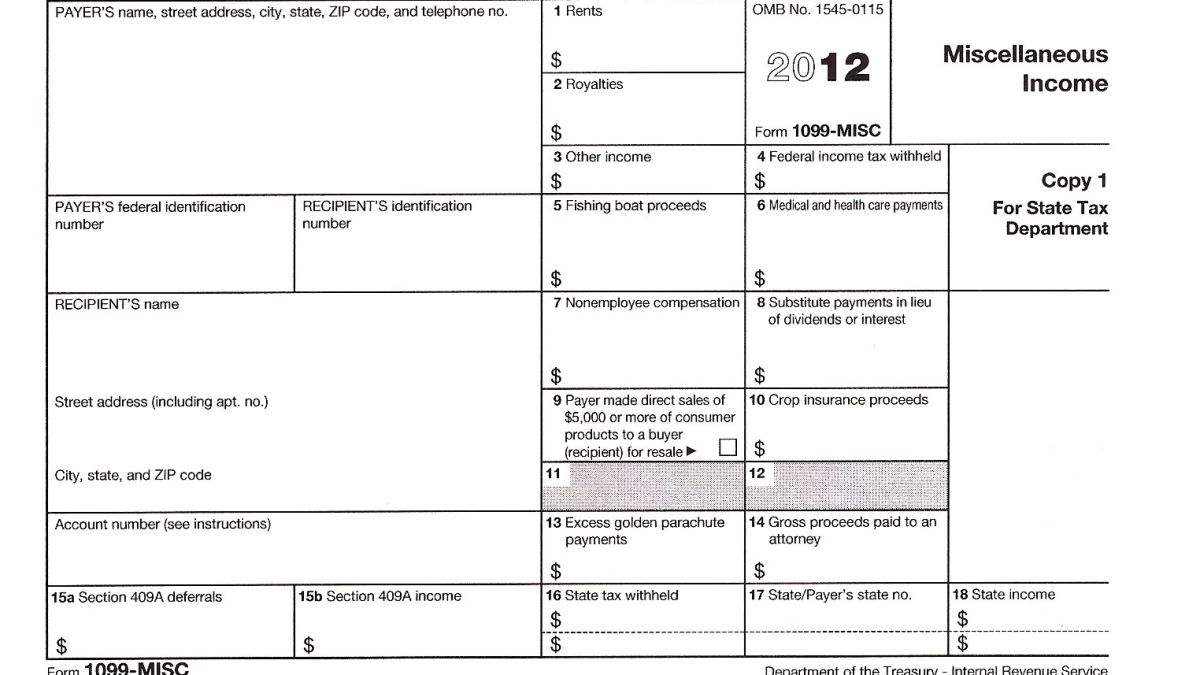

They offer their services to the general public in an independent business. Send a 1099-MISC form in January if you pay 600 or more to any one child care provider during the calendar year using the nonemployee compensation box to report the amount you paid. The IRS requires payers to submit 1099-MISC when they pay an independent contractor more than 600 in a calendar year.

Even if your babysitter could probably be seen as an independent contractor if you hit these payment thresholds you should be filing taxes and providing a W-2 regardless. Basically a 1099 means you are an independent contractor and therefore responsible for all employment taxes employer and employee taxes. If the babysitting was done in the babysitters home you should issue the 1099-MISC to the babysitter be sure to use the Form 1096 Transmittal and mail to the IRS address for your area.

There are exceptions of course. I am wondering if I will be paying and about how much. If you received a 1099-MISC for your self-employed income.

You still need to report your babysitting income on your tax return though even if you dont get a 1099 form from every family you worked for. Usually if youre caring for a relative you dont have a profit motive. Only companies give out 1099 tax forms for services rendered in the course of trade or business.

When you hire a nanny senior caregiver or other household employee you must give them a W-2 to file their personal income tax return. It just breaks down how much income you earned during the year. For the 1099-MISC you will fill out your data and the babysitters data.

That is until they learn more about what this means from a tax perspective. You do not need to send a 1099-MISC form if the provider is a corporation or your employee. Rather youre doing it to help the relative.

Click on Jump to link. I have recently taken a babysitting job since I am a single mother of a 7month old baby girl. I will be earning around 12300 yearlyHowever I use my car to drive to and from her house can i Include my expenses such as.

As a registered business entity you may need to issue 1099-Misc to the babysitter if youre paying her 600 or more in the due course of business and the babysitter or the agency from where the babysitter was hired gets to decide who is supposed to work and how the work is to be done. If youre going to be paying your babysitter less than 1000 in any given quarter and less than 2100 in the year in 2019 you dont have to withhold taxes. Independent contractors are given a Form 1099 to handle their taxes.

For form 1096 you will enter your information and your SSN in box 2. Hiring a babysitter for your kids doesnt require a 1099 form no matter much she charges. If your mother babysits at her home then she is considered an independent contractor and you should issue her an IRS Form 1099-MISC at the end of the year totaling the amount she has received for babysitting.

However she gets paid 20 an hour which adds up quickly. My 14 year old daughter has babysat for them twice since the beginning of the year and she really likes them and really likes the boys she is babysitting. If so she must also file Schedule SE and pay self-employment tax.

Many people have the desire to hire a nanny. Aside from tax forms managing a household employee is a year-round process because there are tax and payroll-related procedures to follow. This means you are paying double taxes while your nanny family pays NO taxes -- because you are paying the employer portion of taxes for them.

The babysitters still must report their income to the IRS. At the end of the year the couple who own a business gave my friend a 1099. Type 1099-misc in the Search box.

Generally speaking because babysitting is a personal service rather than a business expense you do not have to give your babysitter a 1099 tax form. Babysitting Tax Forms. You will enter the income to the babysitter in box 7.

1099 Vs Employee Why The Difference Matters When You Hire A Caregiver Care Com Homepay

1099 Vs Employee Why The Difference Matters When You Hire A Caregiver Care Com Homepay

Do I Need To Issue A 1099 To A Babysitter Or Nanny Amy Northard Cpa The Accountant For Creatives

Do I Need To Issue A 1099 To A Babysitter Or Nanny Amy Northard Cpa The Accountant For Creatives

What Is A 1099 And Why Did I Get One Toughnickel

What Is A 1099 And Why Did I Get One Toughnickel

Are Nannies Employees Or Business Owners Help For Nannies And Home Organizers Ohsosimply

Are Nannies Employees Or Business Owners Help For Nannies And Home Organizers Ohsosimply

What Is A 1099 And Why Did I Get One Toughnickel

What Is A 1099 And Why Did I Get One Toughnickel

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Can I Deduct Nanny Expenses On My Tax Return Taxhub

How Does A Nanny File Taxes As An Independent Contractor

How Does A Nanny File Taxes As An Independent Contractor

How To File Nanny Taxes For Nannies Employers Benzinga

How To File Nanny Taxes For Nannies Employers Benzinga

Do We Need To Give Our Babysitter A 1099 Tax Form 1099 Tax Form Tax Forms Babysitter

Do We Need To Give Our Babysitter A 1099 Tax Form 1099 Tax Form Tax Forms Babysitter

What Is A 1099 And Why Did I Get One Toughnickel

What Is A 1099 And Why Did I Get One Toughnickel

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment