Featured

What Is The Sarbanes Oxley Act

Title I of the Sarbanes Oxley Act establishes the PCAOB as a nonprofit organization that oversees the audits of public companies that are subject to the securities laws. The Sarbanes-Oxley Act Sarbanes-Oxley is a federal law that established new and enhanced standards for public company boards as well as management and public accounting firms.

The act implemented new rules.

What is the sarbanes oxley act. The act also added new criminal penalties for. The main intention of the act is to protect the. To protect investors by improving the accuracy and reliability of corporate disclosures made pursuant to the securities laws and for other purposes.

The Sarbanes Oxley Act SOX created to give protection to workers. Sarbanes-Oxley Act of 2002 - Title I. The Sarbanes Oxley Act gives to the PCAOB four primary responsibilities.

2 establish audit report standards and rules. The Sarbanes-Oxley Act was passed by Congress to curb widespread fraudulence in corporate financial reports scandals that rocked the early 2000s. More stringent auditing standards are followed.

SOX compliance was initiated after fraudulent reporting from prominent companies such as WorldCom and Enron wreaked havoc on financial markets. The Sarbanes-Oxley Act is arranged into eleven titles. 1 oversee the audit of public companies that are subject to the securities laws.

It changes how corporate boards and executives must interact with. What the Act is about. The intent of the the Sarbanes-Oxley Act.

The Sarbanes-Oxley Act of 2002 often shortened to SOX is legislation passed by the US. Public Company Accounting Oversight Board - Establishes the Public Company Accounting Oversight Board Board to. Key Takeaways The Sarbanes-Oxley SOX Act of 2002 came in response to highly publicized corporate financial scandals earlier that.

The legislation came into force in 2002 and introduced major changes to the regulation of financial practice and corporate governance. Whistleblowing employees are given protection. The Sarbanes-Oxley Act also referred to as SARBOX or SOX is Federal legislation that was passed in the US on 30th July 2002 to reform the accounting and corporate finance sector.

The Sarbanes-Oxley Act created new standards for corporate accountability as well as new penalties for acts of wrongdoing. Updated November 17 2020 The Sarbanes-Oxley SOX Act of 2002 is a law that imposes strict financial reporting and auditing requirements on publicly traded companies in order to improve the accuracy and integrity of reporting and ensure the independence of accountants and auditors. These are just a few of the SOX stipulations.

The Sarbanes-Oxley Act Sox of 2002 was enacted by the US Federal Law for increased corporate governance strengthening the financial and capital markets at its core and boost the confidence of general users of financial reporting information and protect investors from scandals like that of Enron WorldCom and Tyco. The Sarbanes-Oxley Act commonly called SOX reformed corporate financial reporting and the accounting profession. - registration of accounting firms that audit public companies in the US.

SOX ensures that all publicly traded US. The Act now holds CEOs responsible for their companys financial statements. The Sarbanes-Oxley Act of 2002 was passed by Congress in response to widespread corporate fraud and failures.

Corporations are required to maintain an adequate system of internal control. Revelations that corporate executives filed misleading financial statements and of cozy. It is the authority to increase corporate governance documentation of corporate internal controls auditor independence and financial disclosures.

Congress to protect shareholders and the general public from accounting errors and fraudulent practices in firms and to improve the accuracy of corporate disclosures. And 3 inspect investigate and enforce compliance on the part of registered public accounting firms their associated. The act created strict new rules for accountants auditors and corporate officers and imposed more stringent.

Named after Senator Paul Sarbanes and Representative Michael Oxley who were its main architects it also set a number of deadlines for compliance. Congress passed SOX in 2002 after a string of corporate scandals most prominently at Enron and WorldCom shocked the public and rattled markets. The Sarbanes-Oxley Act of 2002 SOX was created in response to the accounting scandals of several companies including Enron WorldCom Adelphia and Tyco.

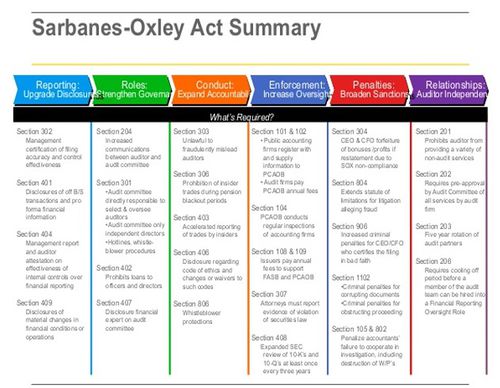

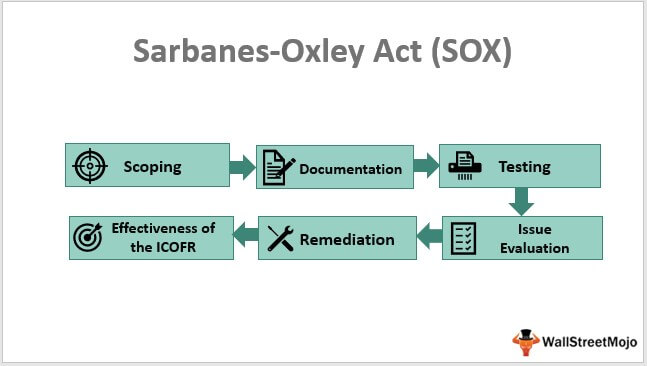

Sarbanes Oxley Act Sox Cio Wiki

Sarbanes Oxley Act Sox Cio Wiki

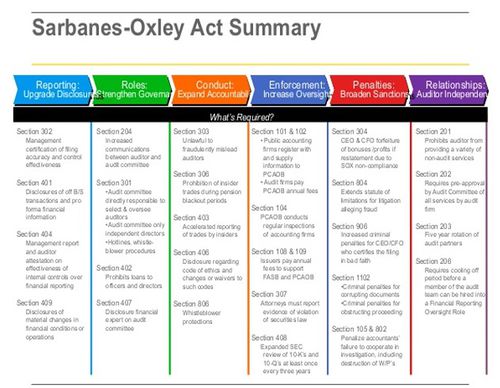

Sarbanes Oxley Act 2002 Sox Definition Steps For Compliance

Sarbanes Oxley Act 2002 Sox Definition Steps For Compliance

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

Sox Compliance For Your Organization Thales

Sox Compliance For Your Organization Thales

Custom Essay Amazonia Fiocruz Br

Custom Essay Amazonia Fiocruz Br

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

302 404 Everything You Need To Know About Sarbanes Oxley

302 404 Everything You Need To Know About Sarbanes Oxley

Kopit Angina Sarbanesa Oxley Act Sarbanes Oxley Act 2002

Kopit Angina Sarbanesa Oxley Act Sarbanes Oxley Act 2002

Us Nonprofits The Sarbanes Oxley Act And Its Impact On Nonprofit Governance Missionbox

Us Nonprofits The Sarbanes Oxley Act And Its Impact On Nonprofit Governance Missionbox

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

What Is The Sarbanes Oxley Sox Act Of 2002 Hwa Alliance Of Cpa Firms

What Is The Sarbanes Oxley Sox Act Of 2002 Hwa Alliance Of Cpa Firms

Impact Of Sarbanes Oxley Act Youtube

Impact Of Sarbanes Oxley Act Youtube

Summary Of Sarbanes Oxley Act Download Table

Summary Of Sarbanes Oxley Act Download Table

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment