Featured

Is It Better To Take Lump Sum Or Annuity Lottery

This is often the preferred option for lottery winners because it allows access to staggering amounts of cash incredibly quickly. No lottery winner is going to save and invest all of their winnings of course.

Winning The Lottery Take The Lump Sum Or The Annual Payments

Lump-sum payments can be a great choice if you have the self-discipline to invest most of it in low volatility dividend-paying stocks.

Is it better to take lump sum or annuity lottery. The math is fairly clear on whether lottery winners should take the annuity or lump sum. So if you ever do win the lottery you are much better off taking the lump sum lottery winnings. While a lump sum payment will ensure that you have immediate access to your winnings this option will actually pay out less than a lottery annuity due to tax laws.

However as with annuity payments it has its own unique pros and cons. If you are not keen on taking your lottery winnings in the form of annuity payments you can choose to receive your winnings in the form of a cash lump sum. A lump sum payment may not be for everyone.

If you dont have discipline not to waste a large sum of money then you may be better off having a company pay you monthly or yearly sums over the course of decades. But winners who take annuity payouts can come closer to earning advertised jackpots than lump-sum takers. If you win the lottery you need to weight the pros and cons of the lump sum and annuity options.

Most big-prize winners opt for the lump sum. The lump sum is the better deal assuming you dont blow most of the money in a hurry and invest at least a big chunk of it instead. There are several reasons why you may want to consider taking monthly annuity payments instead of a lump sum.

If you win the lottery you need to weight the pros and cons of the lump sum and annuity options. Federal taxes reduce lottery winnings immediately. And indeed some financial advisors say that investing the lump-sum payment wisely can result in a significantly better return than the lottery annuity.

For one the annuity is a guaranteed stream of income. If you choose annual payments you are opting for decades of tax payments and numerous legal logistical nightmares. If you win the lottery and opt for annual payments you are just asking for progressively worsening future headaches.

Doing that may get you 3-4 interest which is usually higher than the interest on annuity payments. Header Logo-- -- Rebranding. What Is a Lump Sum Payment.

Common wisdom from financial pundits planners and stock market experts is that you should always take the lump sum if you win the lottery. Taxes also influence many lottery winners decisions on whether to choose a lump-sum payout or an annuity. To past winners the answer has been pretty obvious.

Electing a long-term annuity payout can have major tax benefits. If youre receiving a large sum of money from your pension plan or lottery winnings its important to analyze both payout options before choosing the lump sum or annuity. But you dont get the entire advertised amount of money as it is.

One of the immediate questions whenever someone wins a giant jackpot is whether that lucky person should take their winnings in annual payments or accept a lump sum. Taxes favor taking the lump sum because rates are so low right. Electing a long-term annuity payout can have major tax benefits.

By our own calculations taking the lump sum does indeed make more sense. While an annuity may offer more financial security over a longer period of time you can invest a lump sum which could offer you more money down the road. Once taxed the money can be spent or invested as the winner sees fit.

Some of the advantages of. But winners who take annuity payouts can come closer to earning advertised jackpots than lump-sum takers. In terms of overall analysis the lump sum offers you the opportunity for you to maximize your winnings while annuity lottery payment offers you the opportunity for better financial security.

When you choose a lump sum payment you get your prize all in one payment. Take the time to weigh your options and choose the one thats. Footer Logo-- Education Reference Dictionary Investing 101 The 4 Best SP 500 Index Funds.

The argument is that choosing an annuity lifetime income stream will never beat a well-planned asset-allocated portfolio. From the available Powerball records only four people have actually chosen to take the annuity two groups that won jointly chose a mixture as well despite the lump sum being a lower nominal amount. That will give him the full 228467735 jackpot paid out over 30 years.

By contrast annuity payments will generally add up to a larger amount than the lump sum. Although it may be tempting to take the big pot right now there are also a lot of good reasons to choose the annuity. Some lotteries set up payments that add up to exactly the jackpot amount either through equal payments.

Federal taxes reduce lottery winnings immediately. The advertised 625 million jackpot is the total after the annuity is paid out. The advantage of a lump sum is certainty the lottery winnings will be subjected to current federal and state taxes as they exist at the time the money is won.

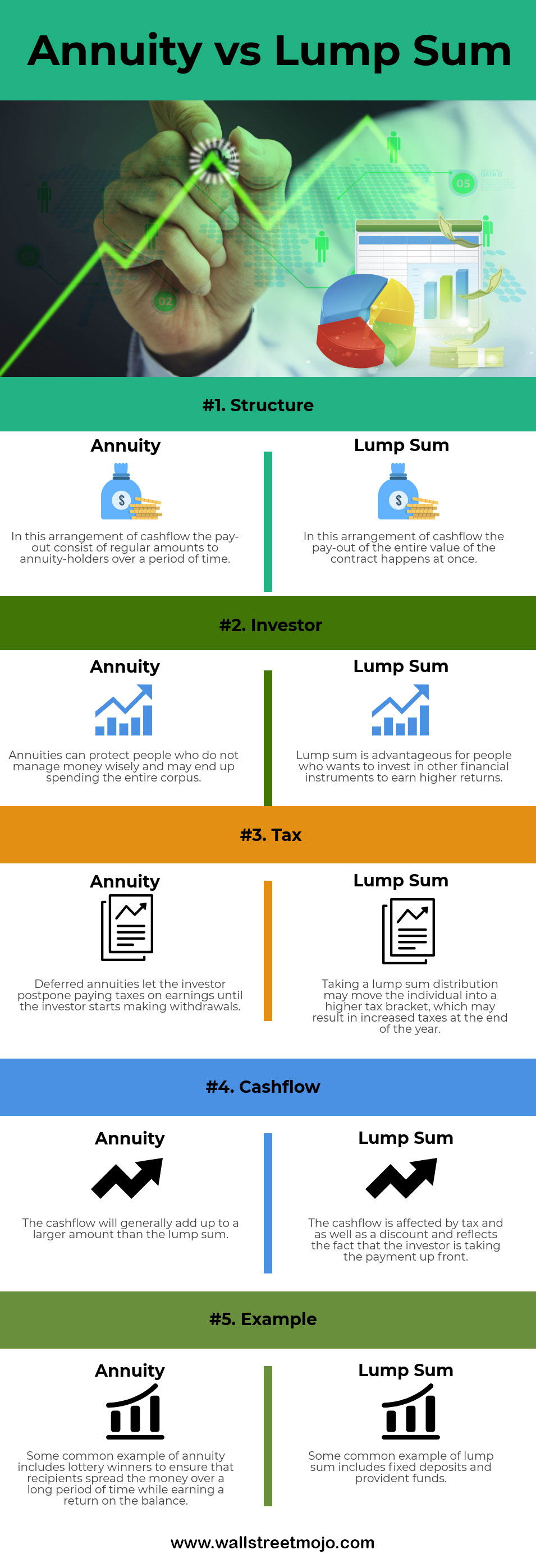

Difference Between Annuity And Lump Sum Payment Infographics

Difference Between Annuity And Lump Sum Payment Infographics

/annuity-not-lump-sum-145904_final-567a4660787149dd8c9a273433080806.gif) How Lottery Winners Gain Choosing Annuity Over Lump Sum

How Lottery Winners Gain Choosing Annuity Over Lump Sum

Mega Millions Jackpot Winner Is Lump Sum Or Annuity Better Money

Mega Millions Jackpot Winner Is Lump Sum Or Annuity Better Money

Won The Lottery Take The Lump Sum Or Annuity Quiz

Won The Lottery Take The Lump Sum Or Annuity Quiz

Annuity Or Lump Sum What Is The Best Lump Sum Or Annuity Youtube

Annuity Or Lump Sum What Is The Best Lump Sum Or Annuity Youtube

Good Question Powerball Take The Lump Sum Or Annuity Youtube

Good Question Powerball Take The Lump Sum Or Annuity Youtube

We Did The Math To See If It S Worth Buying A Ticket For The 393 Million Mega Millions Jackpot

Which Is More Profitable For Lottery Organizers If The Winner Takes Lum Sum Or Annuity Option Quora

Which Is More Profitable For Lottery Organizers If The Winner Takes Lum Sum Or Annuity Option Quora

Lottery Winner S Dilemma Lump Sum Or Annuity

Lottery Winner S Dilemma Lump Sum Or Annuity

We Did The Math For The 450 Million Powerball Jackpot And Concluded It S Not Worth Buying A Ticket Business Oakridger Oak Ridge Tn Oak Ridge Tn

Powerball Mega Millions Jackpot Over 300 Million Expected Value

Here S The Tax Bite On That 425 Million Mega Millions Jackpot

Here S The Tax Bite On That 425 Million Mega Millions Jackpot

Dear Powerball Winner Take Our Advice And Take The Annuity The New York Times

Dear Powerball Winner Take Our Advice And Take The Annuity The New York Times

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment