Featured

How Long Can You Wait To File Taxes

Although it is true that you can wait until next year to file and not be assessed any penalties if you do not owe tax it is also true that you could lose your refund if you wait too long to file. Requesting direct deposit further speeds up the refund process.

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

The law gives taxpayers who fail to file their income taxes three years to submit a return and claim a refund.

How long can you wait to file taxes. If you are due a refund there is no penalty for filing a late Federal return but you have to file your return within 3 years of the original filing date of the return to claim a refund. You cannot e-file an amended return. Regardless of how you file your return do not send us the following.

If we ask you to send supporting documents or receipts you may do so by using My Account. We will send you a notice of determination to inform you. Step 3 CRAs decision.

For example a 2015 return and its supporting documents are safe to destroy. This is because the IRS statute of limitations allows taxpayers only three years from the due date of the original return to file and claim a refund. If you end up having to file for the Recovery Rebate Credit these changes mean you likely wont see your refund until the first week of March at the earliest provided you file electronically.

We may take longer to process your return if. You will receive a letter containing a reference number and instructions on how to proceed. May 31 2019 443 PM You should be filing your tax returns when they are due the IRS does not allow anyone up to two years without imposing a penalty.

There are two timeframes to keep in mind if you need to adjust your tax return. If you sent your Form T2201 with your tax return the CRA will review your application before assessing your tax return. The first milestone is the end of the three-year limitation period usually the three years following the day your original notice of assessment for the particular year was issued.

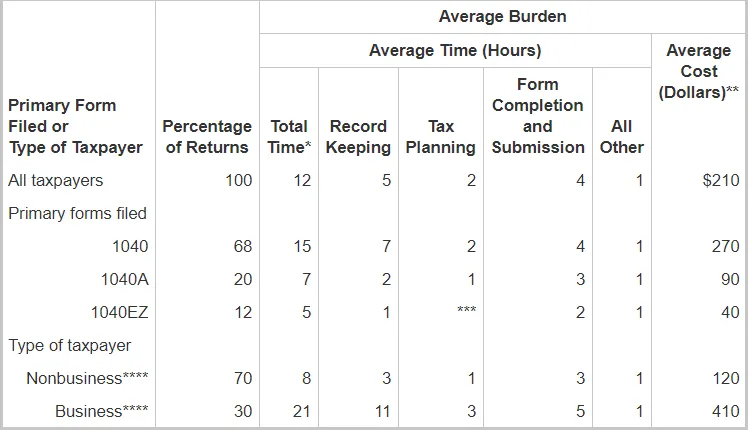

Paper filers can tack on another four to six weeks to that time. Updating self-employment tax forms. There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS doesnt want your returns sooner rather than later.

You can file your return online or by mail or have a person accredited by Revenu Québec file it for you. CRA says filing a tax return is. 8 weeks when you file a paper return These timelines are only valid for returns we received on or before their due dates.

If you are a non- resident and filed a paper return your wait will be up to 16 weeks. Your return will be processed much faster often within 8 business days. Time Requirements for Tax Records The rule for retaining tax returns and documents supporting the return is six years from the end of the tax year to which they apply.

Meanwhile DO NOT go in and start changing anything on your return in the system or you will make a. Your federal information slips except those for income earned outside. If you are still awaiting a refund from the original return wait until you receive it before filing Form 1040X.

You will need to use a form called a 1040X. They have to be mailed and it takes at least 2-4 months for the IRS to process an amended return. Generally the three-year countdown starts on the due date of the return including extensions.

You must have filed tax returns for the last six years to be considered in good standing with the IRS. Filing electronically is the fastest method. According to the Canada Revenue Agency more than two-thirds of Canadians now file their returns electronically.

Once your return has been received by CRA you can track the process in your CRA My Account. During this period most adjustment requests are not subject to CRA discretion. If you Netfile your return the average processing time is 10 business days.

If the 1099 that you forgot to file is for income you received through self-employment and you earned 400 or more from self-employment during the year you will also need to update or file Form 1040SE which lists your income subject to self. 1 2020 youre goodyou wont face any extra fees. However you dont get your return in by the new.

Note that accredited persons who file more than 10 income tax returns for clients are required to file them online Important. The federal tax filing deadline for individuals has been extended to May 17 2021. Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

But your tax refund isnt the only reason to wait to file your tax return as soon as you can as several government benefit programs are related to your tax filing. So long as you file your return by June 1 2020 and pay your 2019 taxes by Sept.

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Why Some Americans Should Still Wait To File Their 2020 Taxes

Why Some Americans Should Still Wait To File Their 2020 Taxes

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

You Have An Extra 3 Months To File Your Taxes Should You Wait The New York Times

You Have An Extra 3 Months To File Your Taxes Should You Wait The New York Times

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif) When Is The Earliest You Can File Your Tax Return

When Is The Earliest You Can File Your Tax Return

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif) When Is The Earliest You Can File Your Tax Return

When Is The Earliest You Can File Your Tax Return

How To File Prior Year Taxes Online Priortax

Should You Wait To File Your Taxes Or File Right Away

Should You Wait To File Your Taxes Or File Right Away

When Can You File Your Taxes This Year Hint It S Very Soon Kiplinger

When Can You File Your Taxes This Year Hint It S Very Soon Kiplinger

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

/mature-couple-calculating-home-finances-506033706-5bd22c53c9e77c00585cc074.jpg) How Many Years Can You File Back Taxes

How Many Years Can You File Back Taxes

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment