Featured

Sued For Credit Card Debt

You can tackle credit card lawsuits on your own or you can receive the assistance of a professional experienced in dealing with debt management and credit counseling. Falling behind or failing to make payments on the credit card typically constitutes a violation of that agreement and the credit card company may then sue you.

Are You Being Sued For A Credit Card In Default Swigart Law Group

Are You Being Sued For A Credit Card In Default Swigart Law Group

Additionally because of our deep concern for the safety of our clients and staff we now offer FREE VIDEO or TELEPHONE consultations for people so they can understand their financial.

Sued for credit card debt. Shawn Jaffer is a Texas Credit Card and Debt Lawsuit Defense Attorney. Some states allow creditors to sue over an unpaid debt for up to 15 years while others permit it for three years. When a credit card company or debt collector sues you it will serve you with a summons.

This is called the statute of limitations. When you are being sued selling credit card debt is a far better alternative to having your accounts frozen your wages garnished or your home repossessed to pay what you owe. As such severely indebted delinquent consumers should be on the lookout for court notices.

Do nothing and the court will assume the debt buyer is telling the truth. For most types of debt Pennsylvania law prohibits filing suit if your last payment was made over four years ago. If youre sued by a debt collector you should respond to the lawsuit.

3 2013 -- Whether the notice comes in the mail or is delivered to your doorstep being told that you are being sued for a credit card debt can be terrifying. The risk of being sued. OBryan Law Offices covers this and much more.

Even if you believe that you owe the debt there are still defenses you can raise and other issues that might reduce the debt or remove it altogether. Can debt collectors sue on old debt. In most instances you will need to raise your defenses in that.

Our Office remains open during this coronavirus pandemic. Being sued for a credit card debt merely means that someone is claiming you borrowed money that you failed to pay that the balance is what they claim it to be and that you are legally obligated to pay this company. It is essential to teach children about the responsibilities of owning and using credit cards.

Most of the time but not all you have at least 6 months of nonpayment before the risk of being sued begins. A Collection Agency Might Buy the Delinquent Credit Card Debt. If youre sued by your credit card company there are some defenses that can help you.

Dont Ignore the Debt Lawsuit. The truth is in certain states financial creditors are allowed to sue you over credit card debt. Before you get sued credit card companies typically try to minimize their losses by selling the debt to a debt collector.

How often do credit card companies sue for non payment. Call today for a free consultation. Are You Being Sued by a Credit Card Company or Debt Collector.

How service is accomplished varies from state to state but no matter where you are sued you will need to respond to the suit within the time provided in the summons. Bankruptcy may be a good option to prevent additional hardships stemming from credit card default. That debt collector becomes the legal owner of the debt.

When you respond or answer the lawsuit the debt collector will have to prove to the court that the debt is valid and that you owe the debt. However if you do owe any significant amount of debt you still have a chance that your creditors could sue you. Lawsuits in the first stage of credit card collections your account has never been sent to a debt collector is not that common but it does occur.

Being sued for a credit card debt happens at different stages of collection. Reach out to them. Therefore you need to know how to respond to a Wells Fargo lawsuit and SoloSuit can help.

They have just as much motivation as you to reach a settlement. If you do not Answer then the Credit Card Company or. Credit Card Lawsuit Dynamics When a credit card debt collector threatens a lawsuit you are officially on notice because laws dictate that legal action seeking to recoup unpaid debt cannot be threatened if it is not being seriously contemplated.

In most circumstances Texas Courts give you just 10 Days to file an Answer to the lawsuit. It applies to credit card debt personal loan debt auto loan debt private student loan. You can respond personally or through an attorney but you must do so by the date specified in the court papers.

Now that doesnt always happen and every persons financial situation can vary based on the creditors. Credit card debt is a non-priority unsecured debt that during bankruptcies comes last in line after youve paid back priority debts like taxes and secured loans. If your credit card company or a debt collector notifies you of a lawsuit with the.

If filing for bankruptcy is the best option for your situation its better to file before a. If you have been sued for Wells Fargo credit card debt it is a lawsuit that you should not ignore. Then you need to contact Attorney Shawn Jaffer for a FREE Consultation about your options.

If you fail to pay a credit card company you may eventually be sued. Are you being sued by a collection law firm on behalf of your original creditor. For many people the first reaction is to shut down and ignore the situation.

How To Avoid A Credit Card Debt Lawsuit Donaldson Williams

How To Avoid A Credit Card Debt Lawsuit Donaldson Williams

How To Avoid Getting Sued Over Old Credit Card Debt

How To Avoid Getting Sued Over Old Credit Card Debt

Sued For Credit Card Debt Here S What You Must Do Now

Sued For Credit Card Debt Here S What You Must Do Now

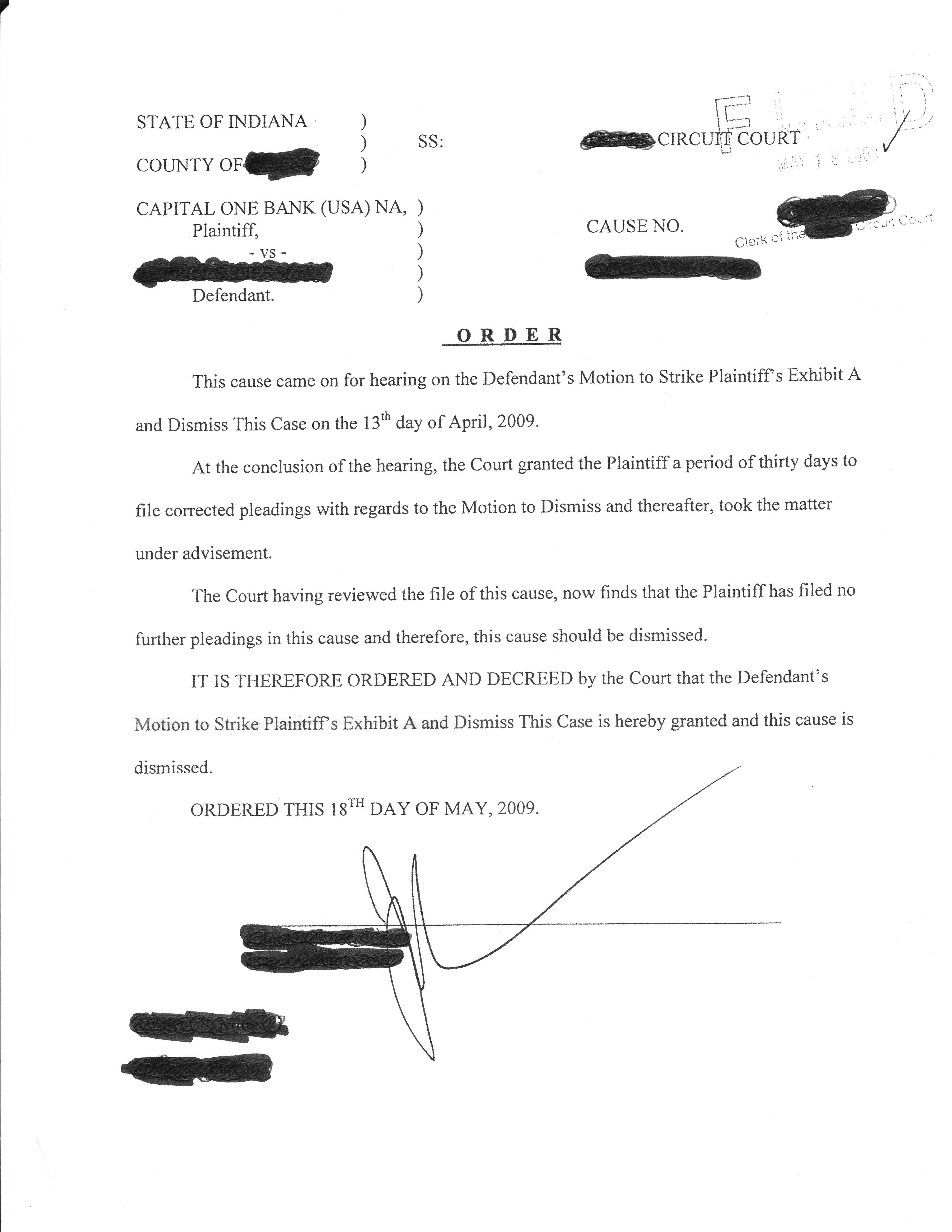

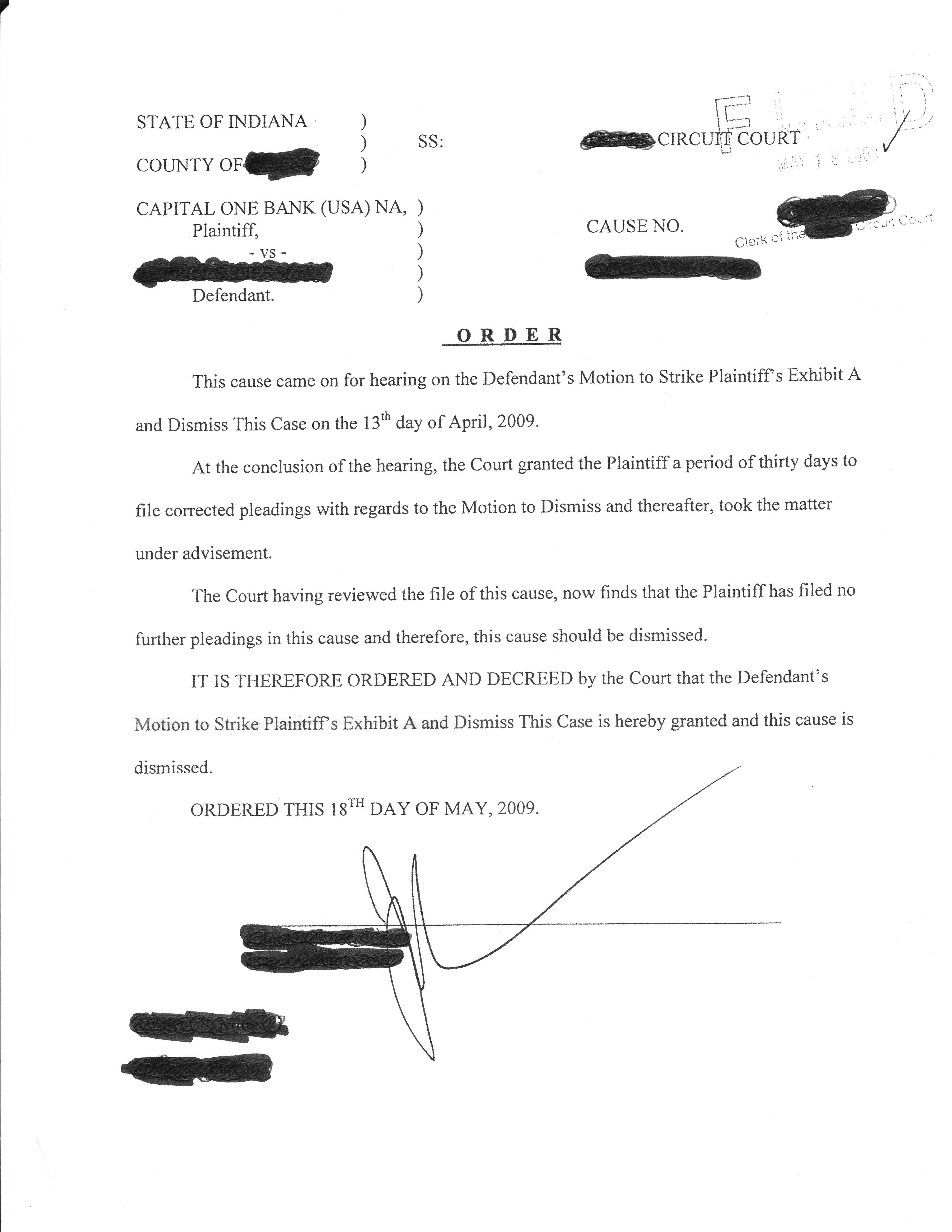

Motion To Strike Credit Card Agreements In Credit Card Debt Lawsuits How To Win A Credit Card Lawsuit

Motion To Strike Credit Card Agreements In Credit Card Debt Lawsuits How To Win A Credit Card Lawsuit

How To Settle Credit Card Debt When A Lawsuit Has Been Filed

How To Settle Credit Card Debt When A Lawsuit Has Been Filed

Syn If You Stop Paying Your Credit Cards Can You Get Sued

Syn If You Stop Paying Your Credit Cards Can You Get Sued

How To Negotiate Credit Card Debt If You Are Being Sued By Daniel Gamez Medium

How To Negotiate Credit Card Debt If You Are Being Sued By Daniel Gamez Medium

What To Do When You Get Sued For Credit Card Debt Bankrate

What To Do When You Get Sued For Credit Card Debt Bankrate

What Happens When Your Credit Card Company Sues You Us News

What Happens When Your Credit Card Company Sues You Us News

What To Do When You Are Sued For Credit Card Debt Youtube

What To Do When You Are Sued For Credit Card Debt Youtube

Sued By A Credit Card Company Texas Debt Relief Lawyer

Sued By A Credit Card Company Texas Debt Relief Lawyer

Can You Be Sued For Credit Card Debt

Can You Be Sued For Credit Card Debt

Can You Be Sued For Credit Card Debts Debt Asylum

Can You Be Sued For Credit Card Debts Debt Asylum

How To Negotiate A Credit Card Debt If You Are Being Sued

How To Negotiate A Credit Card Debt If You Are Being Sued

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment