Featured

Oregon 529 Plan

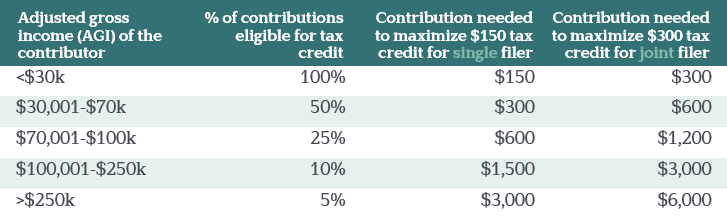

Oregon families can take tax credits worth up to 300 worth of contributions to the plan each year. MFS 529 Savings Plan accounts are considered municipal fund securities.

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions.

Oregon 529 plan. The Oregon College Savings Plan can help you plan for all the possibilities including college trade school apprenticeships and certifications. Get started in just 15 minutes with as little as 25. The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents.

The MFS 529 Savings Plan is a flexible education investing plan sponsored by the state of Oregon acting by and through the Oregon 529 Savings Board and is part of the Oregon 529 Savings Network. Credits for Oregon 529 College Savings Network and ABLE account contributions. The MFS 529 Savings Plan is an advisor-sold savings program and features a 529 share class of MFS mutual funds.

The tax credit went into effect on January 1 2020 replacing the state income tax deduction. The credit replaces the current tax deduction on January 1 2020. You could lose money by investing in an ABLE Account.

Direct this 529 plan can be purchased directly through the state. For more on the changes to the Oregon plan continue reading OR 529 Part 2 here. If youre an authorized representative for an entity or trust account please call 1-866-772-8464.

Rollovers follow federal tax treatment. For a short window of time Oregon taxpayers can qualify for both a deduction and a credit over the next four years. Tax Benefits of the Oregon 529 Plan.

Oregon 529 Tax Benefit For single filers 100 on up to 150yr. The MFS 529 Savings Plan is an advisor-sold savings program and features a 529 share class of MFS mutual funds. Cheap Car InsuranceCar InsuranceCar Insurance QuoteSR22Oregon InsuranceBusiness InsuranceHome InsuranceContractor InsuranceReal Estate.

Qualified distributions from an Oregon and non-Oregon 529 plan are. Best 529 Plans in Oregon. Coverage you can count on.

Oregon is one of the few states that offers a tax credit for contributions - you can get up to 150 if. Sumday Administration LLC manages Oregons direct-sold 529 college savings plan which utilizes several different fund managers. Oregon 529 Savings Board The Oregon College Savings Plan the MFS 529 Savings Plan and the Oregon ABLE Savings Plan are administered by the Oregon Treasury Savings Network which is a division of the Oregon State Treasury.

Is the Program Manager. If this is your first time signing into your Oregon College Savings Plan account since Sumday became the plan manager or if you used a paper enrollment form to sign up you need to create a new password to sign in. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an individual and up to 4865 by a married couple filing jointly in computing Oregon taxable income with a four-year carry forward of excess contributions.

MFS Fund Distributors Inc. The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an individual and up to 4865 by a married couple filing jointly in computing Oregon taxable income with a four-year carry forward of excess contributions. How to use your savings.

Single filers can take up to 150 in tax credits. And Oregon residents with out-of-state family members contributing to your childs 529 can take a deduction or credit for those out-of-state contributions on their Oregon taxes. Oregon 529 Plan Tax Information Contributions.

Amounts invested under the Oregon ABLE Savings Plan are not guaranteed or insured by the State of Oregon the Oregon 529 Savings Network the Oregon 529 Savings Board or any other state agency or subdivision of the State of Oregon. Oregon College Savings Plan. Before you choose a 529 plan from another state or move your 529 plan account find out a whether your state offers tax benefits b whether it limits the tax benefits to a plan sponsored by itself and c whether it claws back the benefits if you move the money out to a plan from another state.

41 rânduri This state offers an in-state tax benefit for contributing to a 529 plan. More information on each Oregon 529 plan can be viewed by clicking on the following links. Starting with contributions made in tax years beginning on or after January 1 2020 a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or.

Oregon College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses.

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Oregon College Savings Plan Oregon 529 College Savings Plan Ratings Tax Benefits Fees And Performance

![]() Treasury Financial Empowerment State Of Oregon

Treasury Financial Empowerment State Of Oregon

Oregon 529 Plan Basics Upromise Articles

Oregon 529 Plan Basics Upromise Articles

Oregon S College Savings Plan Rankings Unchanged On Morningstar Oregonlive Com

Oregon S College Savings Plan Rankings Unchanged On Morningstar Oregonlive Com

Oregon 529 Plan And College Savings Options Or College Savings Plan

Oregon 529 Plan And College Savings Options Or College Savings Plan

15 Things About College Savings Oregon 529 Plan Focus

15 Things About College Savings Oregon 529 Plan Focus

Our Thoughts On Oregon S 529 Plan Northwest Investment Counselors

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

What Is The Oregon College Savings Plan Oregon College Savings Plan

What Is The Oregon College Savings Plan Oregon College Savings Plan

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Oregon Or 529 Plans Fees Investment Options Features Smartasset Com

Oregon Or 529 Plans Fees Investment Options Features Smartasset Com

Oregon College Savings Plan Transition Still Rocky For Some Oregonlive Com

Oregon College Savings Plan Transition Still Rocky For Some Oregonlive Com

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment