Featured

W 4 2020 Tax Form

The way employers will figure federal income tax withholding for the 2020 Form W-4 is changing to match the changes to the new form. 6 2020 2021 November 8 2020 0 Form W-4 updated Dec.

Irs Revises Tax Year 2020 Withholding Form W 4 Yet Again Don T Mess With Taxes

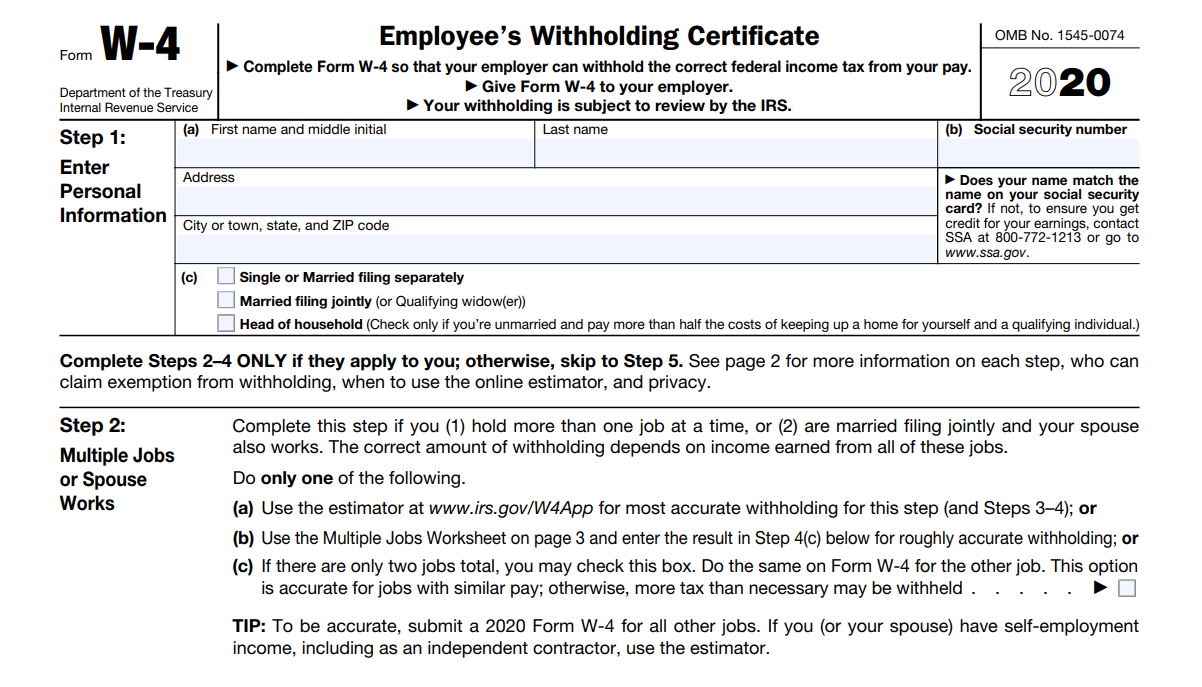

The new form W-4 has been simplified to help employees reduce complexity and increase transparency.

W 4 2020 tax form. On December 5 2019 the IRS released the final version of the 2020 Form W-4. If you would like to use Form W-4 to make an adjustment to your withholding to account for self-employment income that you will receive from another source use the Tax Withholding Estimator at. 10 rânduri Form W-4.

1st Floor Lobby 133 State Street. Learn everything you need to know so you can update your W-4 with confidence. Whether youre filling out paperwork for a new job or got an email notification from HR you might have noticed that the W-4 form changed from what you might have been used to.

Mon Tue Thu Fri 745 am-430 pm. This article lists frequently asked questions and answers about the redesigned Form W-4 and how the changes are integrated with Evolution. Form W-4 2020 FAQs Form W-4 2020 - Frequently Asked Questions Due to the changes to income tax withholding requirements outlined in the Tax Cuts and Jobs Act of 2017 the Form W-4 has been redesigned.

Enter Personal Information a. Since the new form has no withholding allowance adjustment the calculations are based on dollar amounts shown on the form. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the drop-downs and then click the Search button.

5 the IRS released the long-awaited final version of the 2020 Form W-4 retitled Employees Withholding Certificate with major revisions designed to make accurate income-tax. In 2020 the W-4 form changed to help individuals withhold federal income tax more accurately from their paychecks. The new form is for use this year it is.

The IRS has released the final version of the 2020 Form W-4 with some important changes that could impact both employers and workers this tax season. Form W-4 is primarily intended to be used by employees who are not subject to self-employment tax. The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheck.

Employees must complete a W-4 and submit it. Because employees will better comprehend how to fill out the form tax withholdings will be more accurate country-wide. Temporarily Closed to the Public.

Form W-4 updated Dec. Employees have to fill the form out by themselves each year and let the employer know when the financial situation changes and a new W 4 blank form has to be filled. Employees Withholding Certificate 2021 12312020 Form W-4.

Form W-4 changes for 2020. Employers must request the federal tax form W4 from their employees every year or at the time of hiring a new employee. 6 2020 2021 the IRS is changing the w-4 form starting in 2020 how does this impact the way you Read More How to set your W4 Tax Form 2021 to get a Refund or Break-Even.

Understanding 2020 W-4 Form - Updated on May 07 2020 - 1100 AM by 123PayStubs Team When hiring an employee the employer will have the employee complete the IRS Form W-4. In previous years you could claim allowances to reduce or increase your withholding. This form is used to determine the federal income tax amount to withhold from the.

Statewide Public Records Database. The more allowances you claimed the less taxes would be withheld from your paycheck and vice versa. The revisioned Form W-4 for 2020 asks a series of questions to determine your tax liability.

The form was redesigned for 2020 which is why it looks different if youve filled one out before then. Your withholding is subject to review by the IRS. Form W-4 is used to determine your tax withholdings.

The IRS debuted a new W-4 tax withholding form last year thats simpler and more streamlined. Form W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer.

In 2020 the IRS released a new Form W-4 for 2020 with two. Starting in 2020. Thus like the old Form W-4 the redesigned Form W-4 does not compute self-employment tax.

Challenges Of The New Form W 4 For 2020

Challenges Of The New Form W 4 For 2020

Irs Has Lauched A New W 4 For 2020 Insightfulaccountant Com

Irs Has Lauched A New W 4 For 2020 Insightfulaccountant Com

Irs Amends Form W 4 For 2020 Employee Withholding Onyx Tax Tax Relief Irs Representation Charleston Sc

Irs Amends Form W 4 For 2020 Employee Withholding Onyx Tax Tax Relief Irs Representation Charleston Sc

Irs Finalizes New W 4 To Help Taxpayers Correct Withholding Don T Mess With Taxes

/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png) How To Fill Out Form W 4 In 2021

How To Fill Out Form W 4 In 2021

45 Of Taxpayers Don T Remember When They Last Updated Their Withholding Cpa Practice Advisor

45 Of Taxpayers Don T Remember When They Last Updated Their Withholding Cpa Practice Advisor

Https Www Irs Gov Pub Irs Pdf Fw4 Pdf

Treasury And Irs Unveil New Form W 4 For 2020 Accounting Today

Everything You Need To Know About The New W 4 Tax Form Abc News

Everything You Need To Know About The New W 4 Tax Form Abc News

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

:max_bytes(150000):strip_icc()/Screenshot19-f74986306e004d1ca1a01e39b79a3cf1.png)

Comments

Post a Comment