Featured

- Get link

- X

- Other Apps

501c3 Church Restrictions

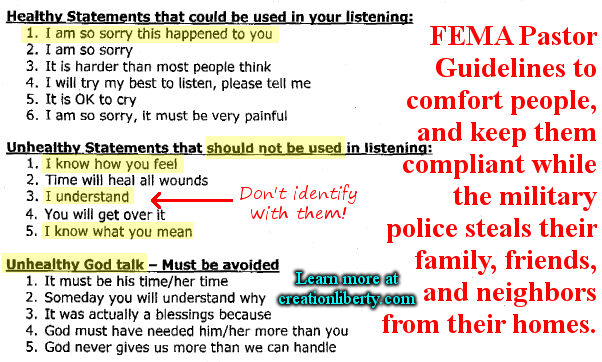

Nonprofits with 501 c 3 tax exempt status should be ever vigilant about this prohibition -- a violation could result in severe consequences. For example by agreeing not to speak out and campaign against morally corrupt politicians.

Center For Nonprofits Covid 19

Center For Nonprofits Covid 19

In order to maintain tax-exempt status 501 c 3 nonprofit organizations cannot engage in political campaigning.

501c3 church restrictions. Churches that meet the requirements of IRC Section 501c3 are automatically considered tax exempt and are not required to apply for and obtain recognition of tax-exempt status from the IRS. So it isnt required for your church to apply for 501c3 in order to be tax exempt. When a church accepts the 501c3 status that church.

501c3 churches are prohibited from addressing in any tangible way the vital issues of the day. Other areas that they often receive discounts include postage and advertising. Only churches wanting to accept grant money must be designated a 501c3.

Under the Internal Revenue Code all section 501 c 3 organizations are absolutely prohibited from directly or indirectly participating in or intervening in any political campaign on behalf of or in opposition to any candidate for elective public office. These restrictions on free speech are in direct conflict with the First Amendment yet most churches have chosen to apply for a determination as a 501 c 3. One need not look far to see the devastating effects 501c3 acceptance has had to the church and the consequent restrictions placed upon any 501c3 church.

One of the biggest advantages of 501c3 tax status is the ability to deduct donations on taxes. Along with federal tax exemptions 501c3 nonprofits usually receive exemptions from state and local sales and property taxes as well. Trump said on Thursday that the federal government has used the power of the state as a weapon against people of faith.

To be a 501 c3 organization is to agree abide by to their rules regulations and law that keeps the organization in alignment operating in accordance to their terms of orderly conduct that is established by them. Theyre also exempt from lawsuits. Keep in mind churches may lobby for legislation or ballot initiatives but they are prohibited from showing support for political candidates.

These organizations are exempt automatically if they meet the requirements of section 501 c 3. The exempt purposes set forth in section 501 c 3 are charitable religious educational scientific literary testing for public safety fostering national or international amateur sports competition and preventing cruelty to children or animals. A church that has built boundaries around itself by 501c3 rules has consented to diminish Yahuwahs law in favor of private civil law.

If a church is shown to be in violation of this restriction they risk losing their exempt status. 3 As social issues have become political issues churches and church leaders are increasingly avoiding issues avoiding taking positions and selectively addressing Biblical principles and training Godly leaders out. The amendment originally a part of the Internal Revenue Code of 1954 prevents all 501 c 3 non-profit organizations from advocating for political candidates.

They do this in order to enjoy an exemption from taxes to which they were immune in the first place. The First Amendment guarantees the right of free exercise of religion and of free speech. Waives its freedom of religion.

Waives its freedom of speech. Churches inter church organizations of local units of a church conventions or associations of churches or integrated auxiliaries of a church such as a mens or womens organization religious school mission society or youth group. Contributions to political campaign funds or public statements of position verbal or written made on behalf of the organization.

One need not look far to see that the churchs acceptance of the 501c3 and its significant restrictions has had devastating consequences to not only the church but to the entire nation. All 501 C 3 ministers have joined in an unholy alliance vowing to obey the State to not violate the rules of the contract they signed up for agreed to. If the church is founded as a 501 c3 the church has free speech restrictions.

Hence the organization becomes in covenant a binding contract with 501 c3 per agreement of their Terms Of Serviceno different from any other service. 2 All 501 c3 organizations are prohibited from influencing legislation and political campaigns.

Https Www Irs Gov Pub Irs Tege Eotopicb79 Pdf

Https Www Irs Gov Pub Irs Tege Eotopicc90 Pdf

Loans Available For Nonprofits In The Cares Act As Amended National Council Of Nonprofits

501 C 3 Church Basics Benefits Disadvantages More Subsplash

501 C 3 Church Basics Benefits Disadvantages More Subsplash

What Is A 501 C 3 Church Benefits Vs Disadvantages Of 501c3 Status

What Is A 501 C 3 Church Benefits Vs Disadvantages Of 501c3 Status

Nonprofit Bylaws Sample Nonprofit Bylaws Nolo

Nonprofit Bylaws Sample Nonprofit Bylaws Nolo

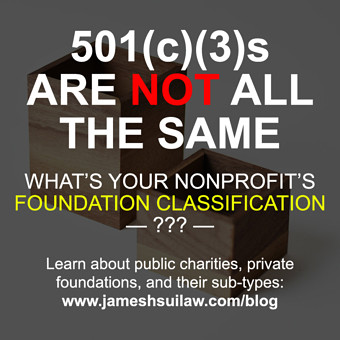

501 C 3 Nonprofit Types Public Charity Private Foundation Classification

501 C 3 Nonprofit Types Public Charity Private Foundation Classification

Common 501 C 3 Rules And Regulations Boardeffect

Common 501 C 3 Rules And Regulations Boardeffect

Using The New Reporting Requirements For Not For Profit Entities The Cpa Journal

Using The New Reporting Requirements For Not For Profit Entities The Cpa Journal

Managing Restricted Funds Propel Nonprofits

Managing Restricted Funds Propel Nonprofits

What Every Nonprofit Board Member Should Know Adler Colvin

What Every Nonprofit Board Member Should Know Adler Colvin

501 C 3 Churches And Religious Organizations Ngosource

501 C 3 Churches And Religious Organizations Ngosource

Amazon Com The Corporation Sole Freeing Americas Pulpits And Ending The Restrictive 501c3 Laws For Churches 9781491291559 Kenny Greenwood Mr Joshua Aaron Books

Amazon Com The Corporation Sole Freeing Americas Pulpits And Ending The Restrictive 501c3 Laws For Churches 9781491291559 Kenny Greenwood Mr Joshua Aaron Books

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment