Featured

How To Lower Credit Score Quickly

Either ask for an increase on your. Credit Cards Lines of Credit Instalment loans Car Loans and sometimes even mortgages.

Infographic How To Raise Your Credit Score Fast Primerates

Infographic How To Raise Your Credit Score Fast Primerates

Request Credit Limit Increases.

How to lower credit score quickly. FICO says that a single hard pull usually only lowers your credit score by five points or fewer. Keeping your credit card utilisation low preferably under 30 per cent of your limit shows lenders that you can manage. On the other hand if your credit scores are being negatively affected because your account is delinquent it may take longer to get.

For a better credit score try not to use too much of your available credit. Your credit report shows how responsibly youve handled debt and expenses over time. Do you have credit card debt that you want to pay off quickly.

Periodically request an increase to your credit limit. Lowering your credit utilization rate could be a great way to boost your credit. How Is a FICO Score Calculated.

But many hard pulls in succession of course multiply that number. Your credit utilization ratio is. As a rule of thumb you never want your credit utilization ratio to go over 30if you have one credit card with a 10000 limit and you owe 1000 on it your credit utilization ratio is 10but if your goal is to quickly raise your score try to get that number down as low as you can.

10 Clever Ways To Improve Your Credit Score Fast 1. Multiply the result by 100 to get a percentage. The lower the utilization the better it is for your credit score.

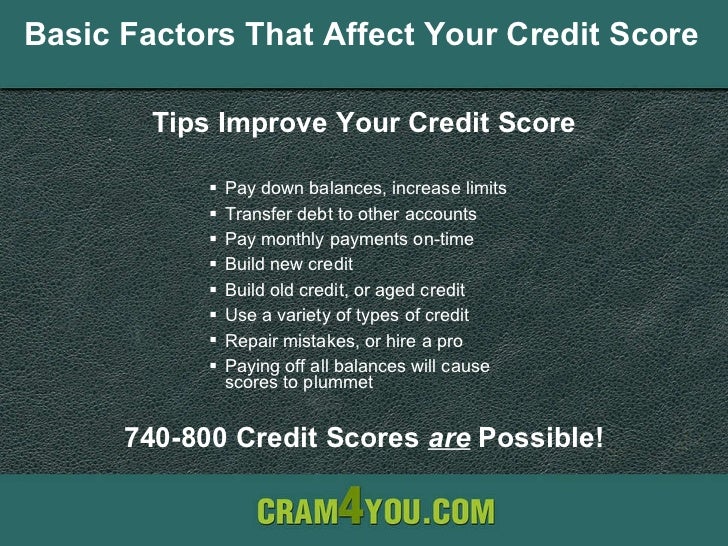

In summary it boils down to paying off any outstanding debt making monthly payments and lower your credit utilization. Then divide that number by your gross monthly income. Several factors determine your credit score.

10 Types of credit used ie. When your credit limit goes up and your balance stays the same it instantly lowers your overall credit utilization which can improve your credit. You can get your credit score for free on Experians website.

10 Credit checks The more you apply for credit the more you will be seen as a. In fact any activity that requires a hard inquiry will lower your credit score and those hard pulls can be sneaky. If you have the funds to pay more than your minimum payment each month you.

15 Credit History Duration The longer the better. Unlike some other credit score factors utilization is a powerful tool for improving your credit in a short time frame says Sarah Davies senior vice president of analytics research and. 4 tips to boost your credit score fast 1.

First pay off your credit cards and lines of credit. In order to do this youll need to get a copy of your full report preferably from all three of the leading credit bureaus. In fact more than 45 of Americans currently have a credit card balance and according to Ben Woolsey.

If Your Credit Card Is Past Due. Reduce Your Credit Utilization Ratio. One of the fastest ways to boost your credit score is to lower your debt utilization ratio which is the difference between the amount of revolving credit thats available to you and the amount that youre actually using.

Once you see that the balance has been updated on your credit report you can order a new credit score to see what impact paying off the account has had on your score. Keep your credit utilization as low. This works because by opening a new credit account you are increasing your overall credit limit which if you dont increase your spending habits decreases your credit utilization rate.

Well youre not alone. You can also raise your credit score by taking positive steps such as paying bills on time and lowering your debt load. And your debt-to-income ratio DTI gives lenders a quick indicator of how much debt you can currently afford.

Increase your credit limit. One of the fastest ways to improve your score is to get any errors or inaccuracies removed from your credit report. Legit Credit Hacks to Improve Your Credit Score As you can see there are a handful of credit hacks you can implement to improve your score.

You can start by adding up your monthly debt payments including credit cards and loans. Your FICO score is based on five major. Pay down your revolving credit balances.

Your credit score assesses the likelihood youll miss a payment in the near future. It shows that you have used only very little of your credit loan. For example if you spend 1200 each month on debt and have a monthly income of 4000 your debt to income ratio would be 30.

Experian Equifax and TransUnion. Each credit card company will. You can increase your credit limit one of two ways.

If you have one or two accounts with low credit limits and havent opened any new accounts within the last six months opening a new credit card account can improve your score.

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

8 Ways To Build Credit Fast Nerdwallet

8 Ways To Build Credit Fast Nerdwallet

/rapid-rescoring-to-raise-credit-scores-4144660-FINAL-5c1d95b9e00d44b8ad2e77529681d052.png) Rapid Rescoring Can Raise Credit Scores Quickly

Rapid Rescoring Can Raise Credit Scores Quickly

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif) How To Boost Your Credit Score

How To Boost Your Credit Score

5 Sneaky Ways To Improve Your Credit Score Clark Howard

5 Sneaky Ways To Improve Your Credit Score Clark Howard

/things-that-boost-credit-score-8ee7c4392e764cceb0deae74b741e000.gif) How To Boost Your Credit Score

How To Boost Your Credit Score

Seven Tips On How To Improve Your Credit Score Quickly Daily Hawker

Seven Tips On How To Improve Your Credit Score Quickly Daily Hawker

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast

How To Improve Your Credit Score Fast

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

Simple Ways To Improve Your Credit Score

Simple Ways To Improve Your Credit Score

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment