Featured

Is Vanguard A Brokerage

Vanguard is a top brokerage platform that offers low-cost mutual funds with no account minimums. Vanguard Brokerage Services is one of the ten largest brokerages in the country and is a legitimate firm that agrees to abide by the rules of its governing bodies.

Vanguard maintains multiple agreements with firms such as TD Ameritrade OptionsHouse Capital One Investing and Interactive Brokers.

Is vanguard a brokerage. Lets take a closer look at this unique broker and see what it has to offer for investors. The personal advisor service does come with a fee of 003 of your total assets. Vanguard does not have a minimum deposit requirement to open taxable or IRA account.

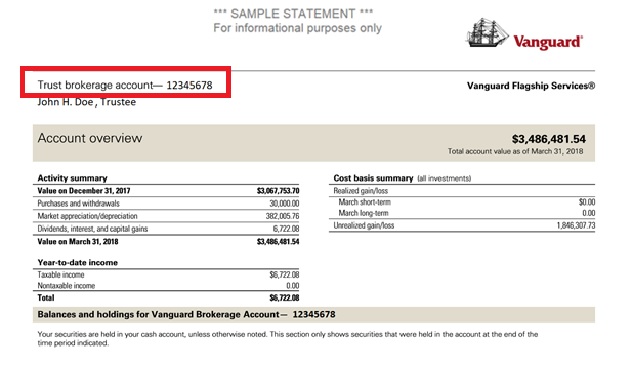

Along with the standard brokerage services Vanguard also offers variable and fixed annuities educational account services financial planning asset management and trust services. In addition if you want low-cost ETFs and other funds Vanguard is an especially great choice. The sooner you move your Vanguard funds to a brokerage account the sooner you can take advantage of these great benefits.

Vanguard is not a broker for active traders so the broker does not offer anything more than a basic order interface. International Canada Europe Australia New. Check out this in-depth Vanguard review and learn if this brokerage account is right for you.

ETFs are subject to market volatility. The Cost of Trading. Vanguard ETF Shares arent redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars.

But active traders will find the broker falls short despite its 0. Who is Vanguards clearing company. Vanguard ETF Shares arent redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars.

The company has a band of loyal followers who swear by the ownership model and pricing structure. Nevertheless since corporations consist of people there is no guarantee that an unscrupulous individual wont try to defraud an investor. Vanguard is self clearing.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. The bottom line. The company currently manages about 51 trillion in global assets from over 20 million investors in about 170 countries.

The Vanguard Brokerage Account offers an easy way to organize and manage all your investments and so much more. However most Vanguard mutual funds have a minimum investment of 3000. It also might make sense as a place for someone who wants to open an IRA and manage it in a very hands-off manner.

Vanguard is a client-owned brokerage firm that provides some unique investment services. Vanguard Personal Advisory Services and Vanguard Digital Advisor the firms robo-advisories are not integrated into the brokerage. The Vanguard brokerage platform also offers personal advisor services that include a customized financial plan goal-setting and investment advice.

For the right kind of investor the lack of a trading platform is not. Vanguard is the perfect brokerage for someone who wants to make basic investments and not think too much about it. Flexibility You can hold Vanguard mutual funds and ETFs exchange-traded funds stocks bonds and CDs.

Founded in 1975 Vanguard is an investment company that offers a large selection of low-cost mutual funds ETFs advice and related services as well as brokerage services for your choice of. Vanguard does not have minimum requirements for brokerage accounts. Vanguard is also a great platform for those who want a no-frills and cost effective option for their portfolio.

Vanguard Brokerage Review Vanguard began operations back in 1975 although its oldest fund the Vanguard Wellington Fund was incepted in 1929. As a result most. See the Vanguard Brokerage Services commission and fee schedules for limits.

Vanguard is the best online brokerage for the buy and hold investor and particularly those with large portfolios of 500k but they are also good for smaller portfolios of at least 3000. When you sell a stock or bond you can reinvest your profits in Vanguard funds right away. Vanguard is the king of low-cost investing making it ideal for buy-and-hold investors and retirement savers.

What minimum deposit is required to open Vanguard account. However in January 2020 Vanguard also became one of several stock brokers that removed commissions on online stock option and ETF trades. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions.

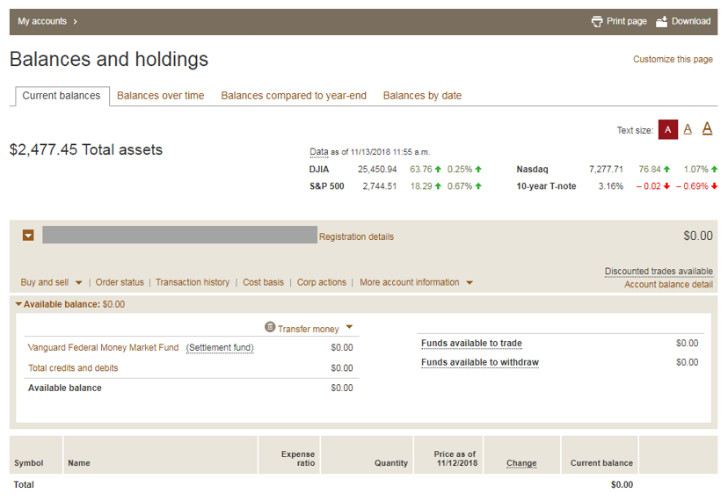

Vanguard Merged Brokerage Account Review Pros And Cons My Money Blog

Vanguard Merged Brokerage Account Review Pros And Cons My Money Blog

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

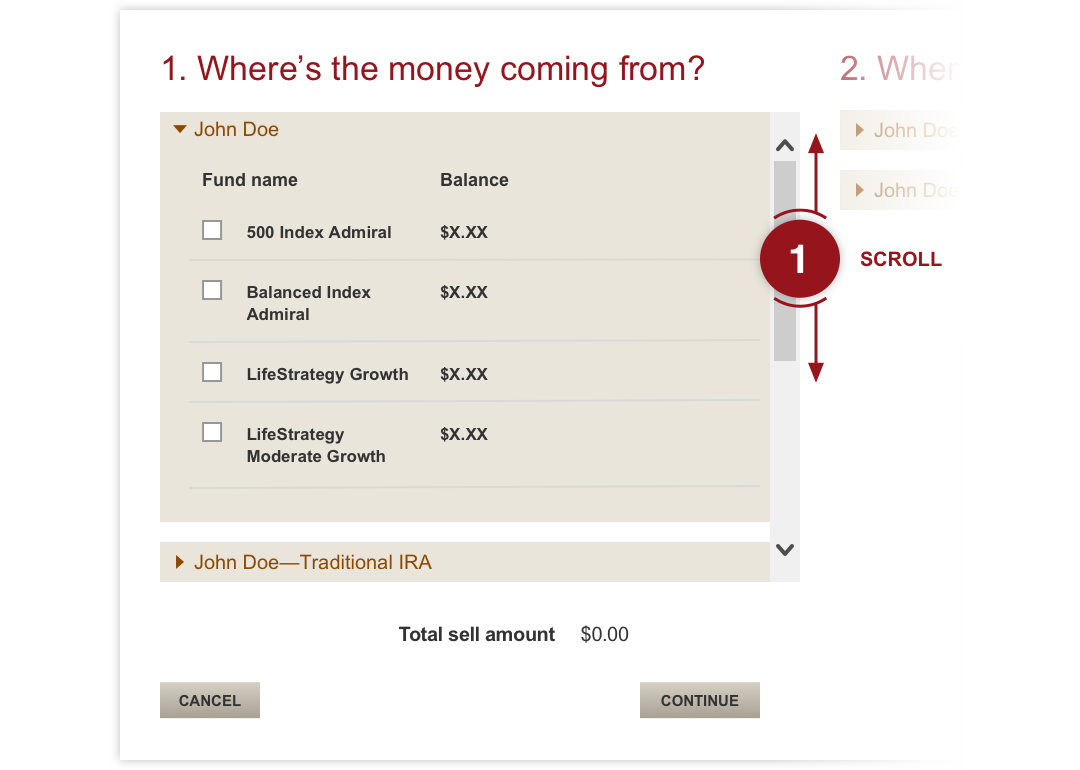

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

How Do I Exchange A Vanguard Mutual Fund For Another Vanguard Mutual Fund Online Vanguard

Vanguard Review 2021 Pros And Cons Uncovered

Vanguard Review 2021 Pros And Cons Uncovered

Tutorial How Do I Set Up Automatic Investments Vanguard Support

Tutorial How Do I Set Up Automatic Investments Vanguard Support

Vanguard Vs J P Morgan Chase 2021

Vanguard Vs J P Morgan Chase 2021

Vanguard Fractional Shares Buy Partial Stock Share In 2021

Vanguard Fractional Shares Buy Partial Stock Share In 2021

How To Close A Vanguard Account Closing Fee 2021

How To Close A Vanguard Account Closing Fee 2021

Benefits Of Vanguard Brokerage Account Is Stock In Trade A Capital Asset Sb Communications

Benefits Of Vanguard Brokerage Account Is Stock In Trade A Capital Asset Sb Communications

Vanguard 101 Automatic Investments Fly To Fi

Vanguard 101 Automatic Investments Fly To Fi

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

:max_bytes(150000):strip_icc()/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

Comments

Post a Comment