Featured

Can You Overdraft With Chase

Chase Overdraft Protection is an optional service that allows you to link a Chase savings account as a backup to help you pay for any overdraft transactions. Additional cutoff times apply to other transfers including transfers from non-.

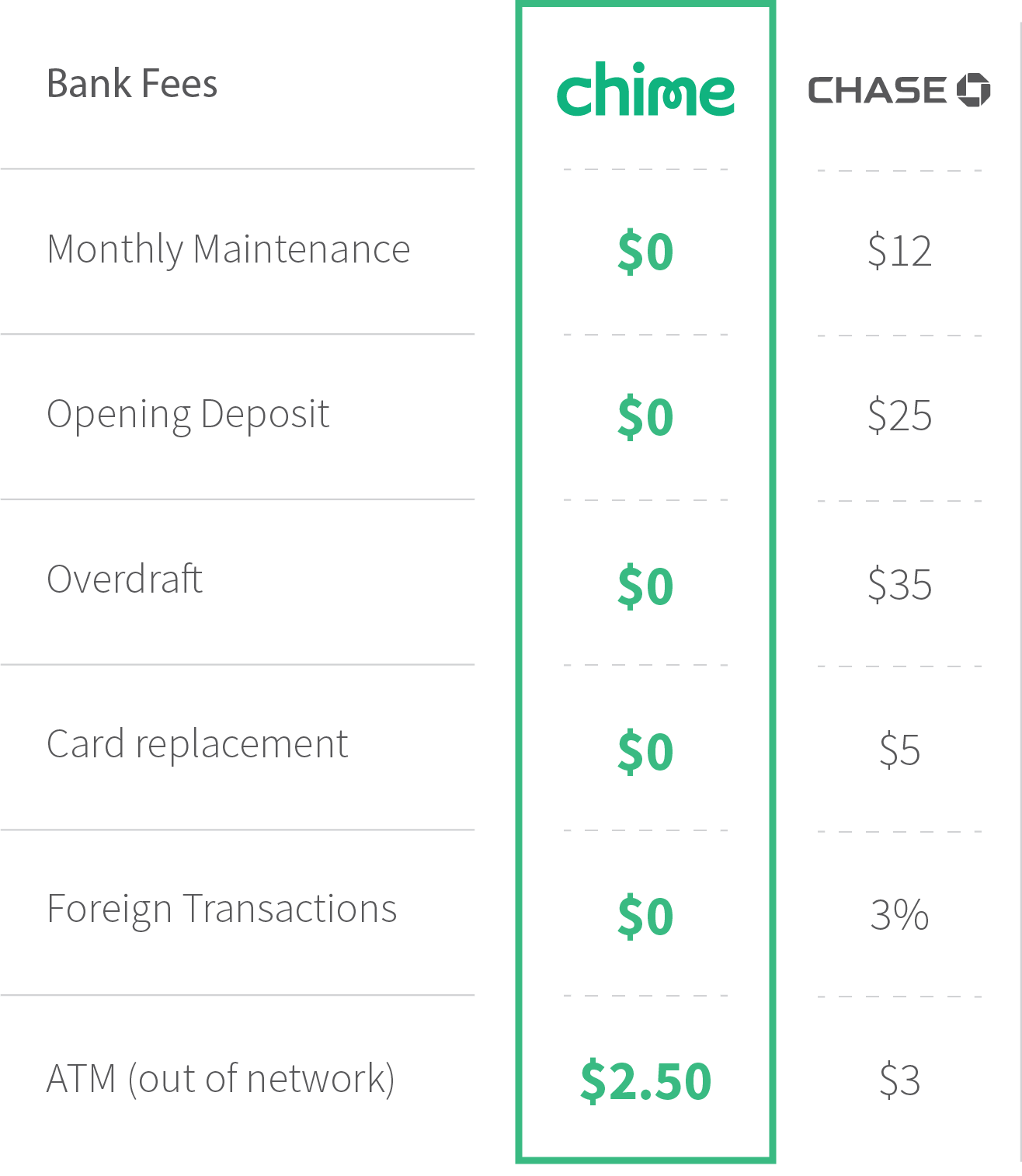

Chase Bank Fees Updated 2020 What To Know And How To Avoid Them

Chase Bank Fees Updated 2020 What To Know And How To Avoid Them

Overdrawing your account will cause you to incur a 34 dollar overdraft fee per transaction and we hold the right to charge 3 such fees per day.

Can you overdraft with chase. Overdraft Protection Link a Chase savings account as a backup to your checking account so we can transfer the exact amount needed to cover an overdraft transaction if the funds are available. We can cover your overdrafts in three different ways. You can opt out of Chase debit card overdraft coverage at any time to avoid the fees and have any transaction for more than your balance be automatically rejected.

In this case you will be charged as follows. Can I overdraft my Chase debit card at an ATM. Under Chases standard overdraft practices Chase will charge you a 34 insufficient funds fee per item if it pays for you unless your Chase account balance is overdrawn by 5 or less at the end of the business day or for items that are 5 or less.

Is Overdraft Protection Worth It. You can contact us to learn more. However it doesnt apply its standard overdraft protection services for a purchase that costs 5 or less or for an overdraft of 5 or less.

Connect a savings or another checking account to your main checking account for automatic coverage when you are out of funds. I am wondering if I can withdraw 40 from my chase account at the ATM and just accept the overdraft fee. If you know you need money and need to withdraw more than you have Wood Forest inside Wal-Mart usually.

The short answer is yes. Their overdraft services comes with most checking accounts they have except for Chase High School Checking and Chase Secure Checking. However you may attempt to use it at a merchant retailer store and it may grant the purchase.

Chase Overdraft Fee Daily MaximumLimit. Chase offers overdraft protection so you can link your savings account to your checking accounts. The amount needed to cover the transaction will be transferred from the available funds in your linked backup account.

Chase Overdraft Protection is an optional service that allows you to link a Chase savings account as a backup to help you pay for any overdraft transactions. Chase returns an item presented for payment when your account does not have enough money 34 fee for each item maximum of 3 Overdraft Fees per day for a total of 102. With Chase Bank overdraft protection refers to a link between your Chase savings account and Chase checking account.

I dont care honestly this is my last option and getting to work is most important. An overdraft fee at Chase happens when theres not enough money in a Chase checking account to cover a payment purchase or check that you write. For instance if you make 8 purchases and all of them get approved youll only get 3 fees.

Can you overdraft a debit card at an ATM. For what its worth I wouldnt overdraft a Chase account for good. I get paid in exactly 1 week and that 5 isnt going to get me across town for the next 5 days.

Our overdraft services arent available for Chase Secure Checking or Chase First Checking. An overdraft occurs when theres not enough money in your personal checking account to cover a payment purchase or check you write. With a Chase checking account you have options specifically when it comes to how we handle overdrafts.

They are high up on the bank chain and getting a bank account again is a nightmare if youre lucky. But if youre enrolled in Chase Debit Card Coverage we may cover everyday debit card transactions and charge a fee. But you need to make sure that you opted-in for that option at your bank.

Special overdraft line of credit is available. If you opt-in for overdraft protection with your bank the transaction will go through you will go home with the item you purchased and you will be charged an overdraft fee usually 35. 2We offer Overdraft Protection through a link to a Chase savings account which may be less expensive than our Standard Overdraft Practices.

Just so you know even if youre enrolled in Chase Debit Card Coverage it wont affect how we treat recurring debit card purchases such as movie subscriptions or gym memberships. Chase will charge you an Insufficient Funds Fee of 34 each time Chase pays an overdraft unless your account is overdrawn by 5 or less or if your account is overdrawn by any item that is 5 or less. 35 per transaction but you can waive the fee if the overdraft is under 10 at the end of the day.

However each transfer will cost you 6. To put it short I have 5 in my Chase account. The amount needed to cover the transaction will be transferred from the available funds in your linked backup account.

We have Standard Overdraft Practices that come with your account. If youre enrolled in Overdraft Protection well transfer your money from savings to cover an overdraft. Overdraft protection is an opt-in service that prevents your transactions from getting declined when you do not have enough funds in your checking account.

3We also offer Chase Debit Card Coverage which allows you to choose how we treat your. Overdraft Protection isnt available for Chase Secure Checking or Chase First Checking. Our Standard Overdraft Practice may pay for a fee overdraft transactions at our discretion based on your account history the deposits you make and the transaction amount.

Overdraft protection basically covers you going over your available funds by transferring money from your Chase savings account. Standard Overdraft Practice comes with all Chase checking accounts except Chase High School Checking Chase Secure Checking or Chase First Checking.

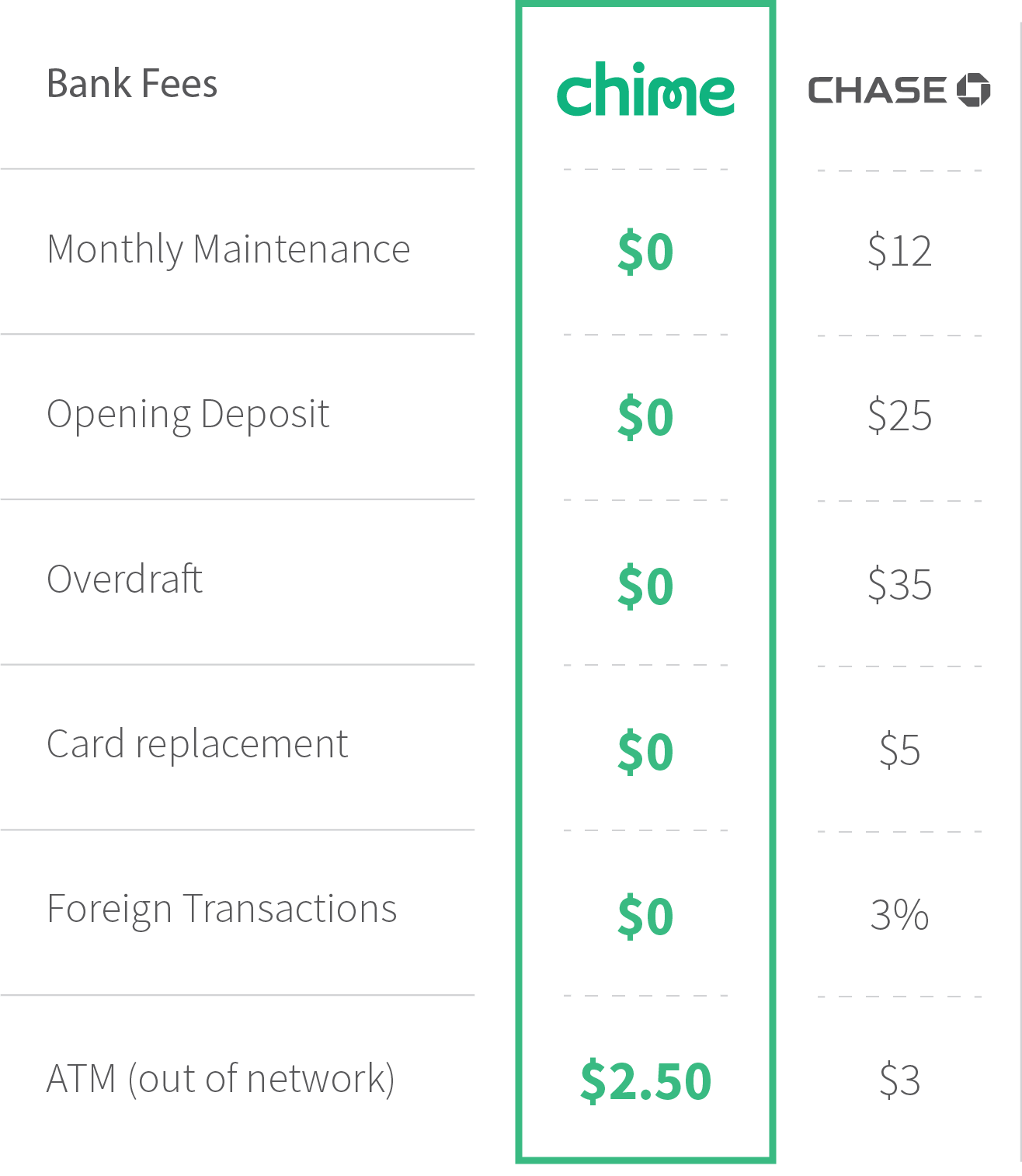

Chase Debit Card Overdraft Coverage And Chase Overdraft Protection Program Oscar Valles

Chase Debit Card Overdraft Coverage And Chase Overdraft Protection Program Oscar Valles

2 Steps To Get Your Chase Overdraft Fees Waived

2 Steps To Get Your Chase Overdraft Fees Waived

Chase College Checking Account Review 2021 A Great Student Option

Chase College Checking Account Review 2021 A Great Student Option

![]() Chase Student Checking Account 2021 Review Should You Open

Chase Student Checking Account 2021 Review Should You Open

Chase Bank Overdraft Fees Youtube

Chase Bank Overdraft Fees Youtube

7 Banks You Can Get Overdraft Fees Waived Or Refunded

How To Lock Chase Debit Card With Mobile App Youtube

How To Lock Chase Debit Card With Mobile App Youtube

Chase S New Overdraft Policy Potential Gotchas For Customers

2 Steps To Get Your Chase Overdraft Fees Waived

2 Steps To Get Your Chase Overdraft Fees Waived

Chase S Overdraft Opt Out Deliberately Confusing Huffpost

Chase S Overdraft Opt Out Deliberately Confusing Huffpost

Chase Mobile App How To Setup Overdraft Protection Youtube

Chase Mobile App How To Setup Overdraft Protection Youtube

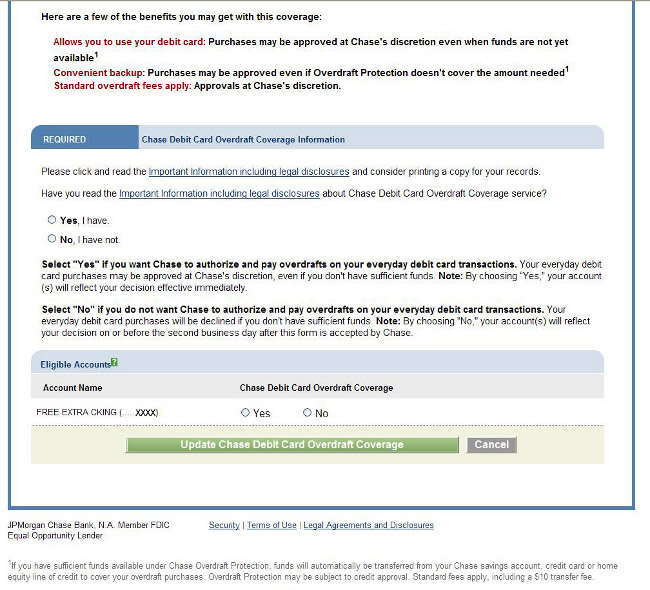

A Chase Bank Teller Makes A Mistake I Spend The Long Weekend 2 300 Overdrawn Consumerist

A Chase Bank Teller Makes A Mistake I Spend The Long Weekend 2 300 Overdrawn Consumerist

Can You Overdraw Your Account At An Atm With Chase Quora

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

.jpg)

Comments

Post a Comment