Featured

High Priced Loan

A higher-priced mortgage loan Higher-priced mortgage loan means a mortgage loan for which the annual percentage rate exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by. You cannot recommend that the.

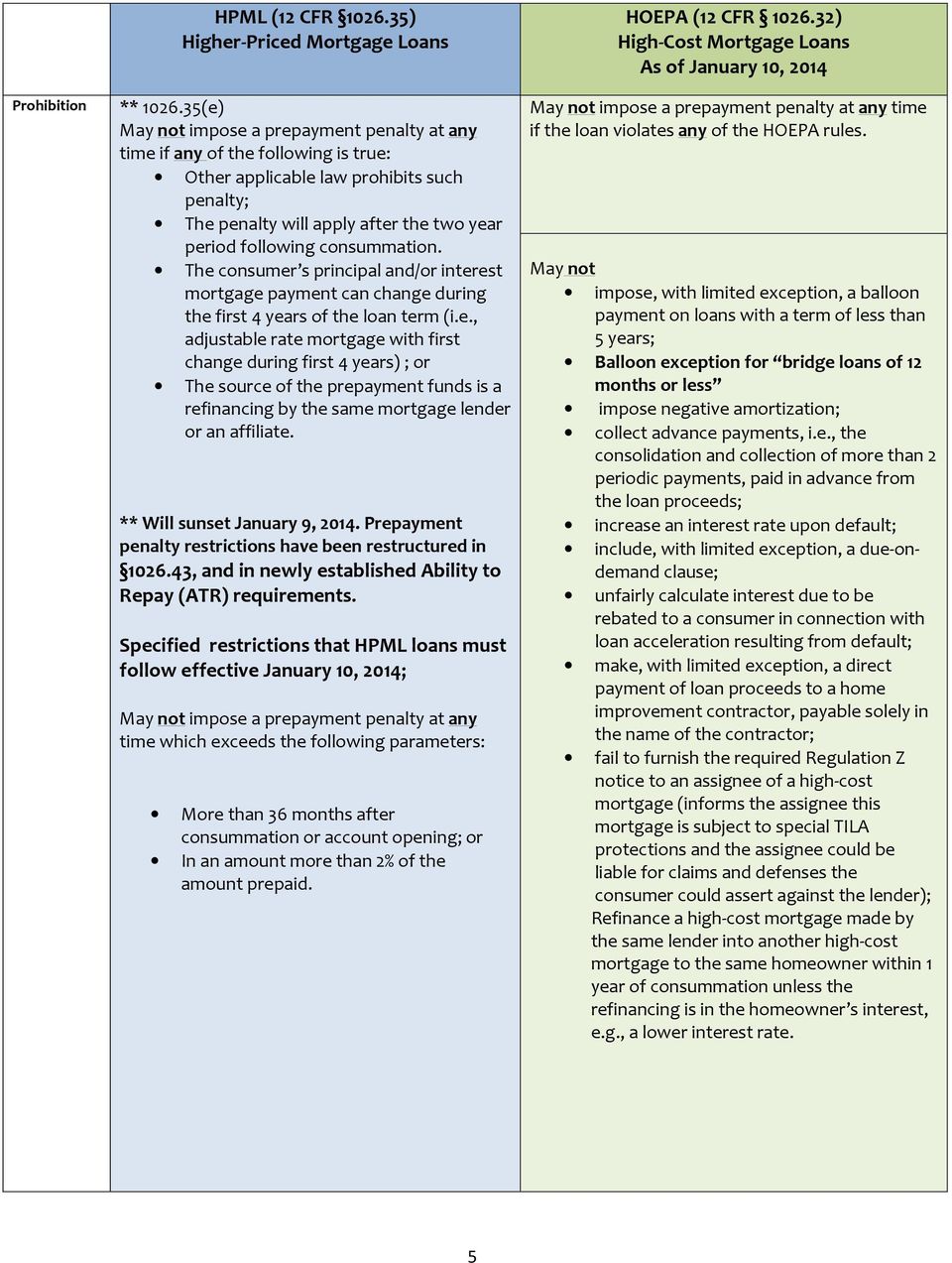

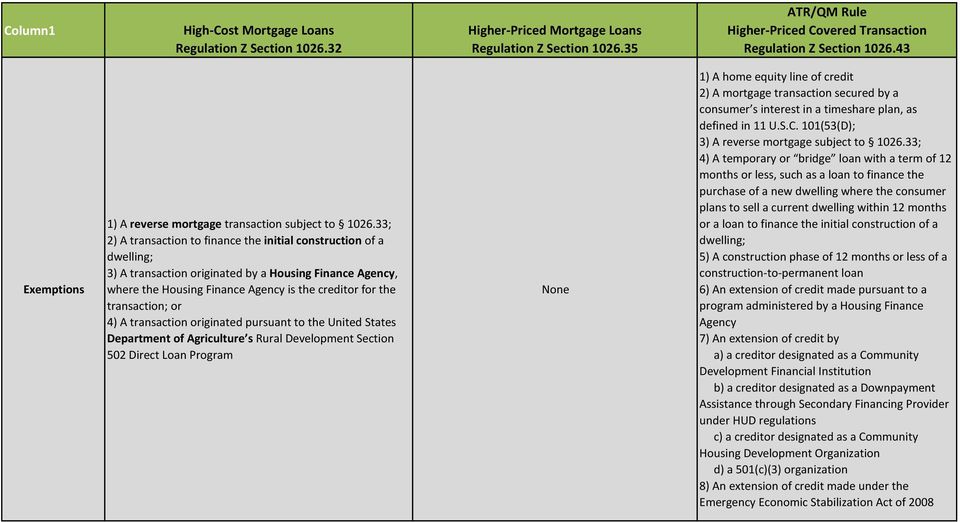

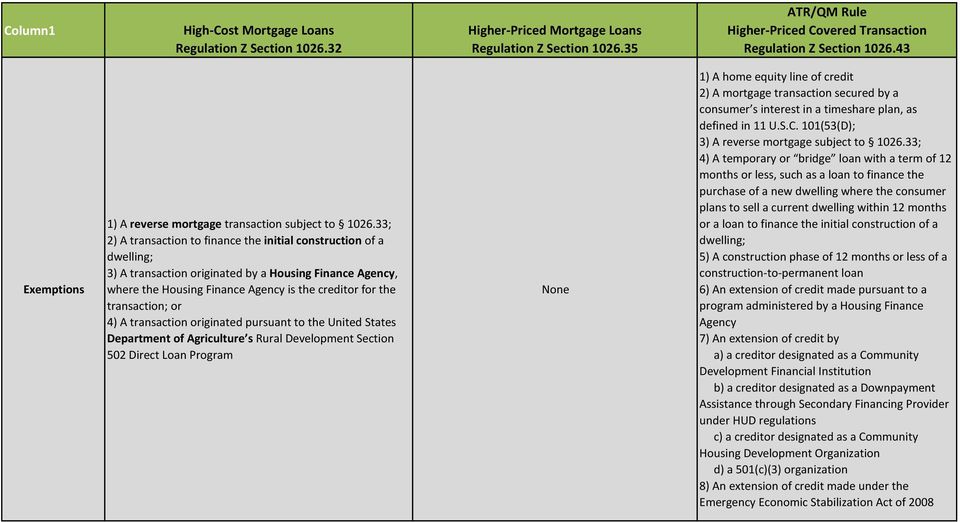

Comparison Of Section 35 Hpml Section 32 Hoepa Regulations Including Cfpb 2013 2014 Updates As Of 01 07 Pdf Free Download

Comparison Of Section 35 Hpml Section 32 Hoepa Regulations Including Cfpb 2013 2014 Updates As Of 01 07 Pdf Free Download

This video will walk you through the basics from APOR percentage differences to t.

High priced loan. Higher Priced Mortgage Loans can include the following terms. This section proposes to have the industry stop using the APR in comparison with the Average Prime Offered Rate APOR for determining if a loan is a high priced mortgage loan. However the statutory definition of higher-risk mortgage differs from the existing regulatory definition of higher-priced mortgage loan in several important respects.

High Cost Mortgage Loan means a Mortgage Loan classified as a a high cost loan under the Home Ownership and Equity Protection Act of 1994 or b a high cost threshold covered or predatory loan under any other applicable state federal or local law or a similarly classified loan using different terminology under a law regulation or ordinance imposing. Also the lender is prohibited from encouraging. Mortgage loans are HPMLs if they are secured by a consumers principal dwelling and have interest rates above certain thresholds as outlined in Section 2 of this guide.

To best use this tool the loan officers at her banks refer to the Consumer Credit Compliance Matrix whenever they do a loan involving real estateThis has a column under Reg Z whereby a covered loan will require the officer to complete. A higher-priced mortgage loan is a consumer credit transaction secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by the specified margin. 1 Higher-priced mortgage loan means a closed-end consumer credit transaction secured by the consumer s principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set.

The table of average prime offer rates published by the Bureau indicates how to identify the comparable transaction. A higher-priced mortgage loan or HPML is a mortgage with an annual percentage rate APR thats higher than the average prime offer rate APOR provided to well-qualified borrowers. An early HCM disclosure must be delivered to the borrower at least three business days prior to closing.

Your mortgage will be considered a higher-priced mortgage loan if the APR is a certain percentage higher than the APOR depending on what type of loan you have. High priced mortgage loan. HPML loans typically come with higher interest rates closing costs and monthly payments.

Higher-Priced Mortgage Loans HPML and the Average Prime Offer Rate APOR The recent amendment to Truth in Lending established a new category called Higher-Priced Mortgage Loans. High-cost loans cant have certain features under federal law such as some types of balloon payments in the terms of the mortgage. Instead the rule creates a coverage rate that is not disclosed to the customer.

A higher-priced mortgage loan is a consumer credit transaction secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by a certain percentage as shown in the following table. A Higher-priced mortgage loans - 1 For purposes of this section except as provided in paragraph b3v of this section a higher-priced mortgage loan is a consumer credit transaction secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by 15 or more percentage points for. There are restrictions on fees and practices such as a limit on late fees to 4 percent of the past due payment.

A higher-priced mortgage loan is a closed-end consumer credit transaction secured by the consumers principal dwelling that has an interest rate in excess of established maximums depending on the amount of the loan and the lien position. A high-cost loan cant charge fees for loan modifications loan or for a loan payoff statement. Points and fees cannot be financed.

Known as HPMLs provisions apply to applications received on or after October 1 2009. Ever wonder the difference between a High Cost and Higher-Priced Mortgage. If your mortgage is a first-lien mortgage the lender of this mortgage will be the first to be.

When you originate a higher-priced first-lien or subordinate-lien loan covered by the HPML Appraisal Rule. She created this High Priced Mortgage Loan Checklist and Worksheet. The coverage rate is calculated using the interest rate and origination charges as the finance charges.

1 Higher-priced mortgage loan means a closed-end consumer credit transaction secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set Commentary to 102623 a 1 3 Principal Dwelling. The HPML Checklist was revised in May 2012 to allow for the 25 Jumbo margin. First the statutory definition of higher-risk mortgage expressly excludes loans that meet the definition of a qualified mortgage under TILA section 129C.

HPMLs are not to be confused with HOEPA loans Home Owner Equity Protection Act which carry different rules.

Http Www Stmpartners Com Manual Cor Products Cr21 018ba Pdf

Https Pdf4pro Com Cdn High Cost Higher Priced What S The Difference Comparison 3d7c5d Pdf

Ability To Repay Qm High Cost Higher Priced Mortgage Loans Youtube

Ability To Repay Qm High Cost Higher Priced Mortgage Loans Youtube

Florida Housing Finance Corporation Training Presentation Sally Mazzola

Florida Housing Finance Corporation Training Presentation Sally Mazzola

High Cost Vs Higher Priced Mortgages Scotsman Guide

High Cost Vs Higher Priced Mortgages Scotsman Guide

Special Rules For Higher Priced Mortgage Loans Marci A Vanadestine Edward J Heiser Jr Ken R Nowakowski Lisa M Lawless Tim H Posnanski Whyte Hirschboeck Ppt Download

Special Rules For Higher Priced Mortgage Loans Marci A Vanadestine Edward J Heiser Jr Ken R Nowakowski Lisa M Lawless Tim H Posnanski Whyte Hirschboeck Ppt Download

Comparison Of Section 35 Hpml Section 32 Hoepa Regulations Including Cfpb 2013 2014 Updates As Of 01 07 Pdf Free Download

Comparison Of Section 35 Hpml Section 32 Hoepa Regulations Including Cfpb 2013 2014 Updates As Of 01 07 Pdf Free Download

High Cost Vs Higher Priced Mortgage What Are The Differences Youtube

High Cost Vs Higher Priced Mortgage What Are The Differences Youtube

High Cost Higher Priced What S The Difference Comparison Of The Similarities And Differences Of Terms In Regulation Z Pdf Free Download

High Cost Higher Priced What S The Difference Comparison Of The Similarities And Differences Of Terms In Regulation Z Pdf Free Download

/what-you-need-to-know-about-jumbo-loans-4155160_final2-e8b7d0e5ae39414e9a306c0eadcca732.jpg) How Jumbo Loans Can Help You Buy High Priced Homes

How Jumbo Loans Can Help You Buy High Priced Homes

What Are High Priced Loans Sonoma County Mortgages

What Are High Priced Loans Sonoma County Mortgages

Https Docecity Com Download Comparison Of Section 35hpml 1pdfnet Html

What Is High Cost Loan How Do We Substitute High Cost Loans With Low Cost Loans Ep 36 Youtube

What Is High Cost Loan How Do We Substitute High Cost Loans With Low Cost Loans Ep 36 Youtube

Popular Posts

How To Tell The Difference Between Lice And Dandruff

- Get link

- X

- Other Apps

Comments

Post a Comment